To us it is not just about comparing and selecting financial products, it goes beyond that. At the heart of what we do is focussing on the individual, your circumstances, your objectives, and your aims. We focus on offering a truly independent personalised service to our clients enabling us to develop long lasting relationships. Every solution is truly bespoke and based on long-term financial solutions.

Our unique service offers advice in several key areas, such as investment portfolio management, estate planning, taxation strategies, life cover solutions and retirement planning ideas. As we work together to manage and preserve your wealth, plan for your retirement, or protect your estate from inheritance tax, the services detailed in this section can have a part to play, depending on your specific requirements.

As a Coleridge Capital client, you can be fully assured that everything we do, is with you in mind.

The idea of affluence depends on where you want to go and the financial security you wish to attain.

Each of our clients is unique, that’s why we begin by understanding your financial personality, getting to know you, your circumstances, your attitude towards investment risk, any investment preferences you may have and what you want your wealth to achieve for you and your family. This enables us to provide you with the appropriate services and level of advice and support you need.

You may be looking to grow the long-term value of your wealth, to provide an income for your later years or to pass capital on to future generations. A successfully managed wealth portfolio is one that balances investment potential with a level of risk that you find acceptable. Increasingly, growing the value of your portfolio entails keeping abreast of market intelligence, factoring in the effects of global developments, and blending a diversified range of investments from different sectors of the economy and markets, in the UK and around the world.

For those with a higher risk appetite, then investment vehicles such as Enterprise Investment Schemes (EIS), Seed Enterprise Investment Schemes (SEIS) and Venture Capital Trusts (VCT) can be effectively used. Our independence means we have access to the whole of market to find the best solutions for your needs.

Many parents are looking for ways to save for the big events in their child’s life – schooling, university fees, a deposit on a property or a wedding.

We help our clients put in place the right plans for their needs, giving them as much or as little control as they would like over the money saved for their children.

There are a number of savings options available. They each have different tax rules and provide access to the money at various ages. We will help you make the right choices based on your circumstances and aims.

Public concern for the environment, including the impact of climate change, has reached its highest level in recent years. There is now a growing realisation that investors can have a significant role to play in addressing the environmental and social challenges the world is facing.

By being independent, we engage with our preferred list of investment managers to provide a range of solutions that focuses on Environmental, Social, Governance (ESG) investments, i.e. those looking to make a more positive impact on the future. Investor’s requirements from investments that do no harm and are at the cutting edge of those technological and environmental advances to build a more sustainable world.

One of the most important goals on our client’s journey is towards financial freedom through the accumulation of a substantial pension portfolio. We ensure that our clients make use of all available tax allowances and employ a blend of strategies designed to ensure that when they choose to celebrate their retirement, they have built up substantial assets.

Once in retirement, our focus is on the tax-efficient drawdown of their income.

We design specific wealth management strategies that match your individual aims, objectives and circumstances, that utilises not only a range of pension structures, but also makes use of other tax allowances such as building an ISA portfolio to provide tax free income.

If you are self-employed, in a partnership, a company director, business owner or executive, we can advise you on a wide range of pension arrangements, including Self-Invested Personal Pensions (SIPPs) and Small Self-Administered Schemes (SSASs). As part of our holistic approach to your finances, we will also advise you on income drawdown, cashflow management and Inheritance Tax planning.

We all want to keep our families safe and properly protected. Understandably, nobody wants to dwell on the unwelcome and unexpected events that life sometimes has in store. This means that it can be all too easy to overlook the benefits of protection insurance that could be a great help financially in the case of an accident, illness or death.

We help our clients ensure they have the right types of policy in place across a range of potential risk scenarios, providing much-needed peace of mind for them and their families.

It is important to remember that protection policies don’t just pay a lump sum on death or the diagnosis of a critical illness, they can also play a major role in estate and business planning, help parents pass their wealth on to future generations tax-efficiently, and can have a major role to play in inheritance tax planning too.

We offer practical advice on protection policies that would provide a lump sum or a regular income if disaster were to strike, meaning your family would be able to pay off the mortgage and other debts, and continue to have the lifestyle they enjoy.

If you were diagnosed with a life-threatening illness that meant you were too ill to work, then we can arrange a policy which would provide a regular tax-free replacement income, removing financial worries and avoiding the need to dip into capital at a difficult time.

There is a simple and effective way to legally avoid Inheritance Tax (IHT) on any policy pay out that we regularly recommend to our clients. Life policies written under trust don’t form part of an estate when it comes to calculating IHT. They have another benefit too; life policy proceeds can be paid out before probate is granted and therefore provide an effective means of getting money quickly into the hands of beneficiaries.

We are able to advise and assist clients in the mitigation of their tax liabilities, helping them to preserve and pass as much of their wealth as possible to their heirs.

Inheritance Tax is paid if a person’s estate (their property, money and possessions) is worth more than £325,000 when they die. Your estate will owe tax at 40% on anything above the £325,000 inheritance tax threshold (or 36% if you leave at least 10% of your net estate to a charity). Married couples and civil partners are able to pass their possessions and assets to each other tax-free (if UK-domiciled) and the surviving partner is allowed to use both tax-free allowances (when not utilised at the first death), effectively doubling their combined nil-rate band to £650,000.

We can help you to reduce the amount of IHT that would otherwise be payable. This can include measures to invest in tax-efficient share schemes or business ventures, giving away assets in your lifetime, taking out life insurance policies, setting up trusts, making gifts from your surplus income, maximising the use of your annual tax-free allowances, or giving money to charity.

We can help ensure your Will reflects your wishes and is written in a way that will take into consideration inheritance tax mitigation. We oversee powers of attorney and trust implementation and we will work with your lawyers to update and manage this process.

We offer full independent mortgage advice from across the whole market to provide a tailored one-to-one advisory service.

With the various lenders active in this market operating under differing mortgage criteria, rates and charges, we know how important it is that you get the right mortgage for your needs. We have an established network of lenders that we work with on a regular basis, meaning we can find the best deal available for you and your circumstances.

The types of mortgages we frequently advise our clients on include:

Loans in excess of £1M

Buy-to-let

Mortgage for the self-employed

Equity release/lifetime mortgages

Effective tax planning can make a significant difference to the tax you pay. What is more, not having the right plans in place can lead to your capital being substantially eroded.

We work with you to assess your financial position and put in place measures to ensure that you make optimal use of the tax-free allowances available to you. Simple but effective income tax planning steps can include using ISAs or transferring savings to your spouse to eliminate or reduce income tax (and capital gains tax), putting as much as possible into your pension plan, and making the right investment choices.

At Coleridge Capital this is an ongoing process that ensures that your tax optimisation strategy takes into account your financial goals and reflects any changes in your circumstance’s year-by-year. It is designed so that when you reach retirement, your assets will be structured in such a way that your income and capital will be subject to the lowest possible rates of taxation.

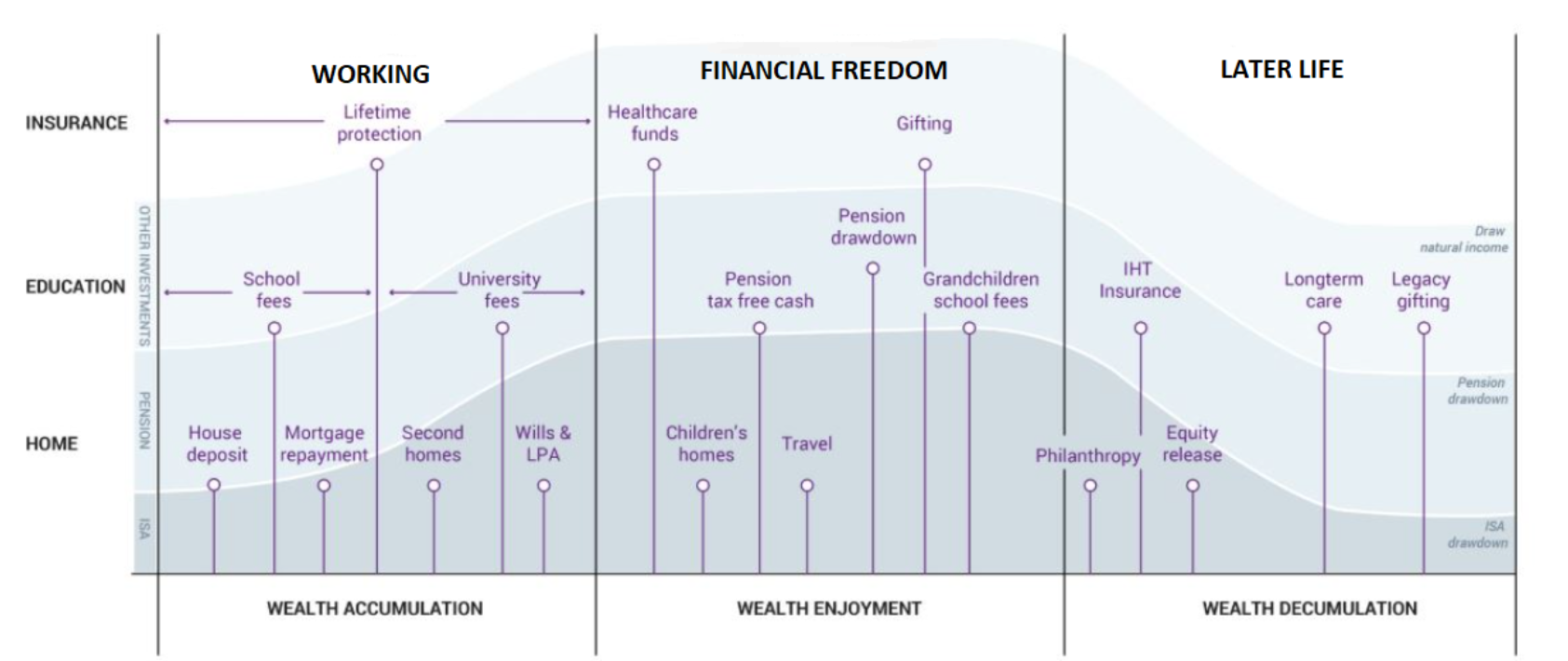

Having a clear understanding of your financial needs will help you prioritise your goals and objectives. Determining where you currently are in your financial journey can enable us to work with you to plan effectively for you and your families future.