Quarterly Market Review

3rd Quarter 2025

3rd Quarter 2025

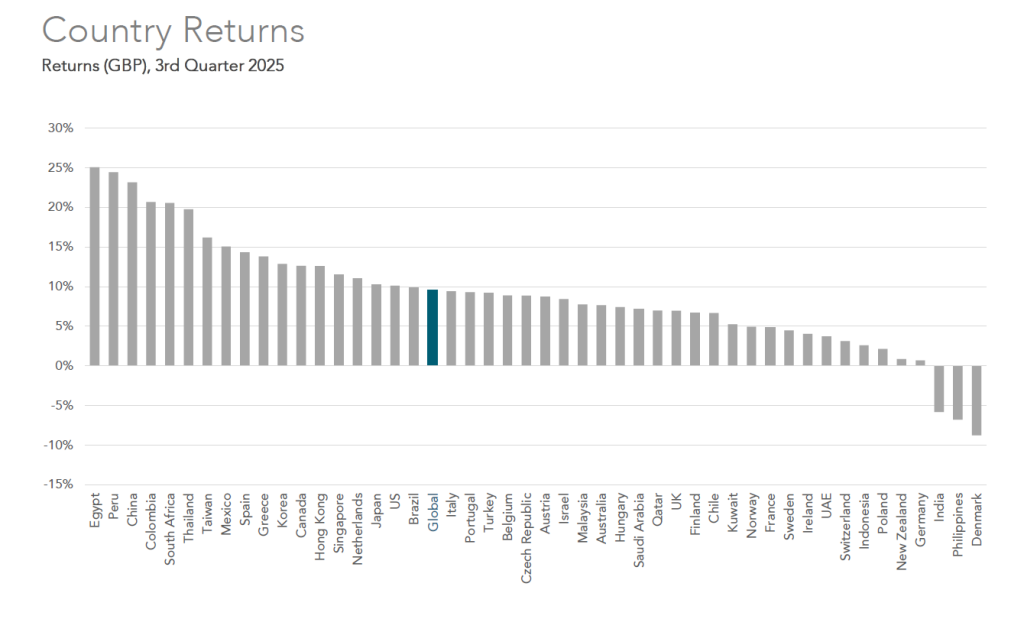

Here's a breakdown of what happened last quarter. This is for those of you interested in aspects such as which countries returns were higher and whether it was Value / Growth or Smaller companies that performed better in the period.

This is also evidence that maintaining well-diversified, long-term thinking in your investment approach rather than reacting to short term valuations is key. We can help you develop and monitor carefully considered plans to meet your life objectives for the future which is probably more important to you.

Happy Diwali!

Risks : Buying Investments can involve risk. The value of your Investments and the income from them can go down as well as up and is not guaranteed at anytime. You may not get back the full amount you invested. Information on past performance is not a reliable indicator for future performance. This information is intended for educational purposes and should not be considered a recommendation to buy or sell a particular security. The views expressed here are subject to change without notice and we can’t accept any liability for any loss arising directly or indirectly from any use of it.

To discuss your financial requirements or obtain other information click below

Mind the Gap - Diversifying Across Countries

While many of us enjoy an international holiday this summer it might be timely to talk about countries!

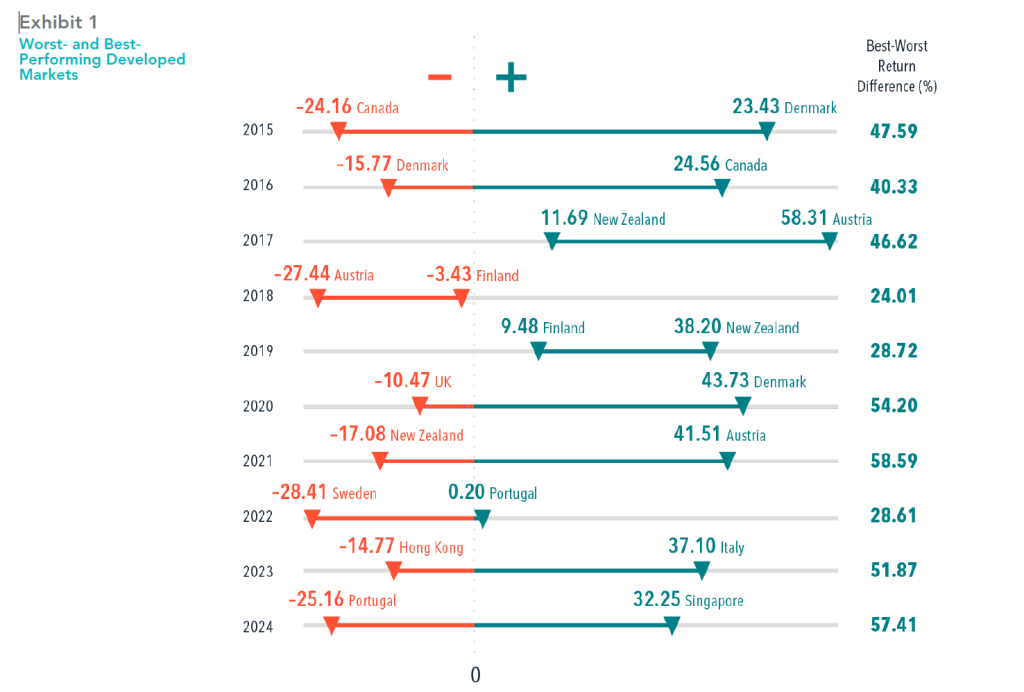

Recently, there’s been a lot of noise around which country one should invest their savings in for the best growth, and the idea of allocating away from the US for many reasons. In the first half of 2025, developed markets outside the US returned 19.0%, outperforming the US and emerging markets. But that outcome masks the wide range of returns across individual countries, from Spain’s 43.0% to Denmark at −5.5%. This kind of dispersion isn’t unusual—it’s a defining characteristic of global investing.

On average, the difference in return between the best- and worst-performing country

exceeded 43% over the past 10 calendar years. It’s no wonder investors may be tempted to chase recent winners or try to avoid losers. However, there’s little evidence that timing strategies consistently pay off. Country returns can turn quickly. For example, Canada posted the worst returns in 2015, down over 24%, but was the top performer in 2016, up over 24%. An investor who lost patience at the end of 2015 potentially missed out on the subsequent market recovery.

Country volatility is a normal part of global investing. Fortunately, as 2025 illustrates,

investors in a globally diversified portfolio can benefit from international diversification

without risking getting on the wrong side of country swings.

In USD. The US is included in the developed markets analysis. MSCI data © MSCI 2025, all rights reserved. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Risks : Buying Investments can involve risk. The value of your Investments and the income from them can go down as well as up and is not guaranteed at anytime. You may not get back the full amount you invested. Information on past performance is not a reliable indicator for future performance. This information is intended for educational purposes and should not be considered a recommendation to buy or sell a particular security. The views expressed here are subject to change without notice and we can’t accept any liability for any loss arising directly or indirectly from any use of it.

To discuss your financial requirements or obtain other information click below

Share this article with your friends by clicking below

Quarterly Market Review

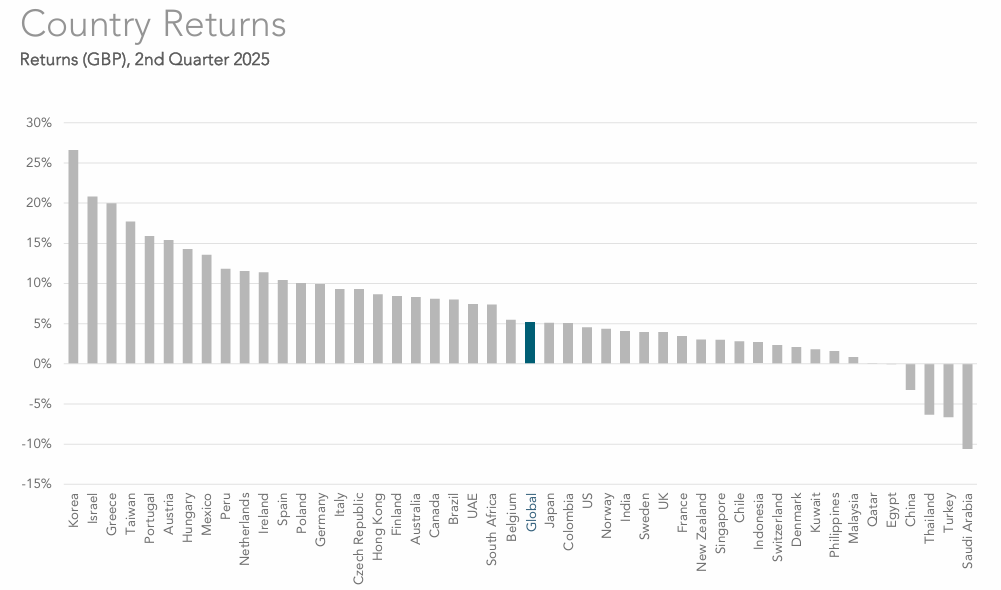

2nd Quarter 2025

2nd Quarter 2025

Here's a breakdown of what happened last quarter. This is for those of you interested in aspects such as which countries returns were higher (Korea!) or whether Value / Large or Smaller companies performed better in the period. There is also a Long-Term Market Summary and Average Quarterly Returns for Stocks and Bonds going back 20 years!

This should provide comfort that maintaining a well-diversified investment approach, rather than making predictions about what will come next, is more reliable for your savings.

With this in mind we help develop carefully considered financial plans to achieve your life objectives for the future which is probably what matters more to you!

Risks : Buying Investments can involve risk. The value of your Investments and the income from them can go down as well as up and is not guaranteed at anytime. You may not get back the full amount you invested. Information on past performance is not a reliable indicator for future performance. This information is intended for educational purposes and should not be considered a recommendation to buy or sell a particular security. The views expressed here are subject to change without notice and we can’t accept any liability for any loss arising directly or indirectly from any use of it.

To discuss your financial requirements or obtain other information click below

MARKET INSIGHTS: The Cost of Trying to Time the Market

Considering how dire the headlines and stock price moves appeared to be in April with the Tariff headlines I know it’s tempting to move to the sidelines and delay making investments or even sell and wait and see how things develop with a view to ‘re-entering the market’ when valuations might be more attractive and the outlook clear. The problem is the evidence suggests that approach rarely works out! With new record highs being made in the US stock market last week I thought it’s worth reflecting on this.

The impact of being out of the market for a short time can be profound, as shown by this hypothetical investment in the MSCI World Index, a broad Global stock market benchmark.

- A hypothetical £1,000 investment made in 2015 turns into £3,214 for the 10-year period ending December 31, 2024.

- Miss the MSCI World’s best week, and the value shrinks to £2,940. Miss the best three months, and the total return falls to £2,498.

- There’s no proven way to time the market—targeting the best days or moving to the sidelines to avoid the worst. Staying invested and focused on the long term helps to ensure that you’re in position to capture what the market has to offer.

In GBP. For illustrative purposes. Best performance dates represent end of period (April 08, 2020, for best week; April 14, 2020, for best month; June 18, 2020, for best three months; and September 15, 2020, for best six

months). The missed best consecutive days examples assume that the hypothetical portfolio fully divested its holdings at the end of the day before the missed best consecutive days, held cash for the missed best consecutive days, and reinvested the entire portfolio in the MSCI World Index (net div., GBP) at the end of the missed best consecutive days. Data presented in the growth of £1,000 exhibit is hypothetical and assumes reinvestment of income and no transaction costs or taxes. The data is for illustrative purposes only and is not indicative of any investment. MSCI data © MSCI 2025, all rights reserved.

Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio.

Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio.

Risks : Buying Investments can involve risk. The value of your Investments and the income from them can go down as well as up and is not guaranteed at anytime. You may not get back the full amount you invested. Information on past performance is not a reliable indicator for future performance. This information is intended for educational purposes and should not be considered a recommendation to buy or sell a particular security. The views expressed here are subject to change without notice and we can’t accept any liability for any loss arising directly or indirectly from any use of it.

To discuss your financial requirements or obtain other information click below

Share this article with your friends by clicking below

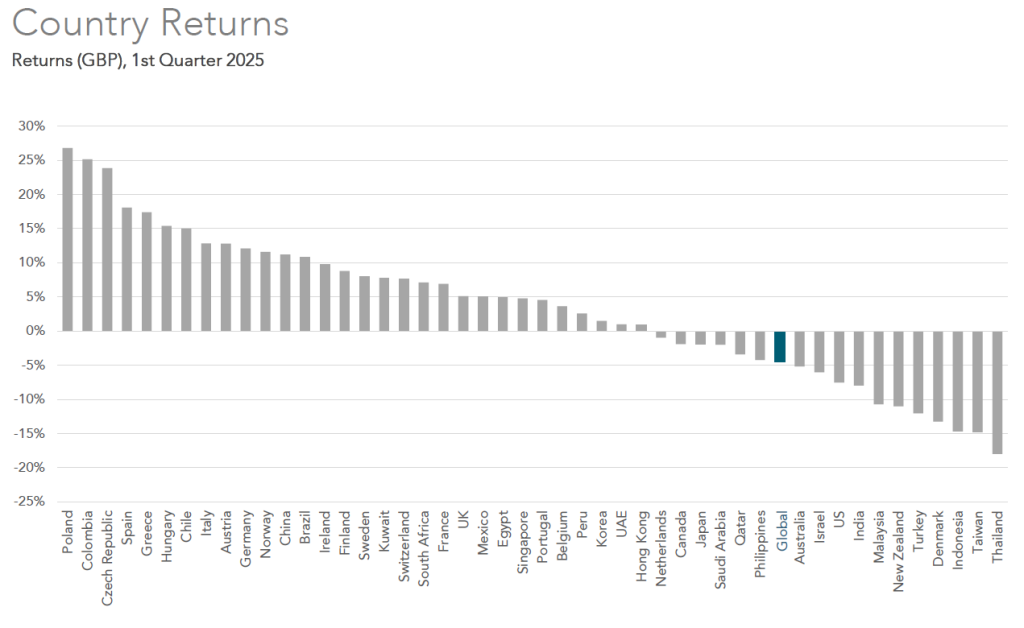

Quarterly Market Review

1st quarter 2025

Here's a breakdown of what happened last quarter. This is for those of you interested in aspects such as which countries returns were higher or whether Value / Growth or Smaller companies performed better in the period. I am aware that there have been many movements since April however for the purpose of completeness this covers the first quarter of the year.

This is also evidence that maintaining well-diversified, long-term thinking in your investment approach rather than reacting to daily valuations is key. We can help you develop and monitor carefully considered plans to meet your life objectives for the future which is probably more important to you!

Risks : Buying Investments can involve risk. The value of your Investments and the income from them can go down as well as up and is not guaranteed at anytime. You may not get back the full amount you invested. Information on past performance is not a reliable indicator for future performance. This information is intended for educational purposes and should not be considered a recommendation to buy or sell a particular security. The views expressed here are subject to change without notice and we can’t accept any liability for any loss arising directly or indirectly from any use of it.

To discuss your financial requirements or obtain other information click below

Chasing the returns of the biggest stocks in the US?

If top stocks exert a gravitational pull on the broad market’s return, the Magnificent 7 (Apple, Nvidia, Amazon, Tesla, Meta, Microsoft, Alphabet)have acted like the TON 618 black hole over the US the past few years.1 Accounting for about one-third of the S&P 500 Index’s weight2, the performance of these stocks has been a big driver of market-capitalization-weighted US large cap stock index returns.

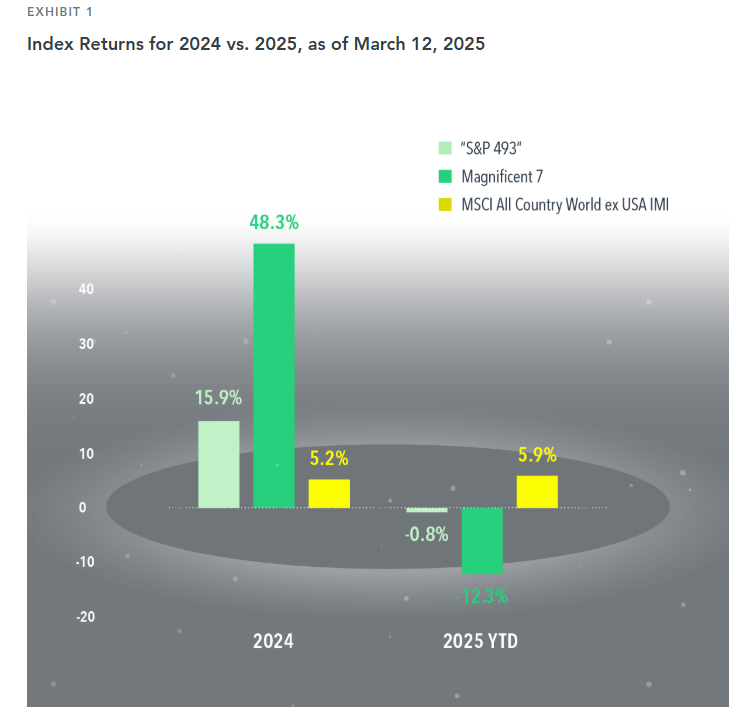

This force can pull in a positive or negative direction. In 2024, the S&P 500 returned 25.0%. This was driven heavily by the Magnificent 7, which returned 48.3%. The other 493 stocks in the index collectively returned 15.9%. This year, the opposite effect has played out: The Magnificent 7 returned –12.3% through March 12, compared to –0.8% for the “S&P 493.”

The swings in performance for a US large cap index make a compelling case for global all cap diversification, which helps lessen exposure to the Magnificent 7. While non-US stocks underperformed the US in 2024, the MSCI All Country World ex USA IMI Index is outpacing the US thus far in 2025. Diversifying across regions and market capitalization is one way to mitigate the impact of a handful of stocks.

Risks : Buying Investments can involve risk. The value of your Investments and the income from them can go down as well as up and is not guaranteed at anytime. You may not get back the full amount you invested. Information on past performance is not a reliable indicator for future performance. This information is intended for educational purposes and should not be considered a recommendation to buy or sell a particular security. The views expressed here are subject to change without notice and we can’t accept any liability for any loss arising directly or indirectly from any use of it.

To discuss your financial requirements or obtain other information click below