Quarterly Market Review

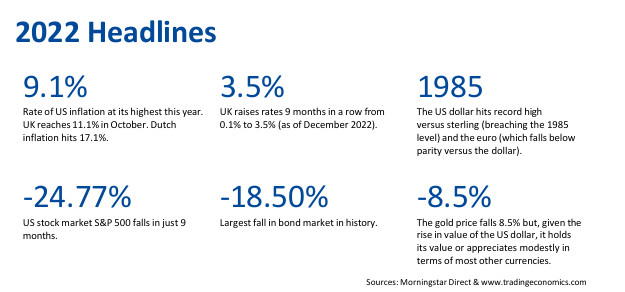

3rd Quarter 2025

3rd Quarter 2025

Here's a breakdown of what happened last quarter. This is for those of you interested in aspects such as which countries returns were higher and whether it was Value / Growth or Smaller companies that performed better in the period.

This is also evidence that maintaining well-diversified, long-term thinking in your investment approach rather than reacting to short term valuations is key. We can help you develop and monitor carefully considered plans to meet your life objectives for the future which is probably more important to you.

Happy Diwali!

Risks : Buying Investments can involve risk. The value of your Investments and the income from them can go down as well as up and is not guaranteed at anytime. You may not get back the full amount you invested. Information on past performance is not a reliable indicator for future performance. This information is intended for educational purposes and should not be considered a recommendation to buy or sell a particular security. The views expressed here are subject to change without notice and we can’t accept any liability for any loss arising directly or indirectly from any use of it.

To discuss your financial requirements or obtain other information click below

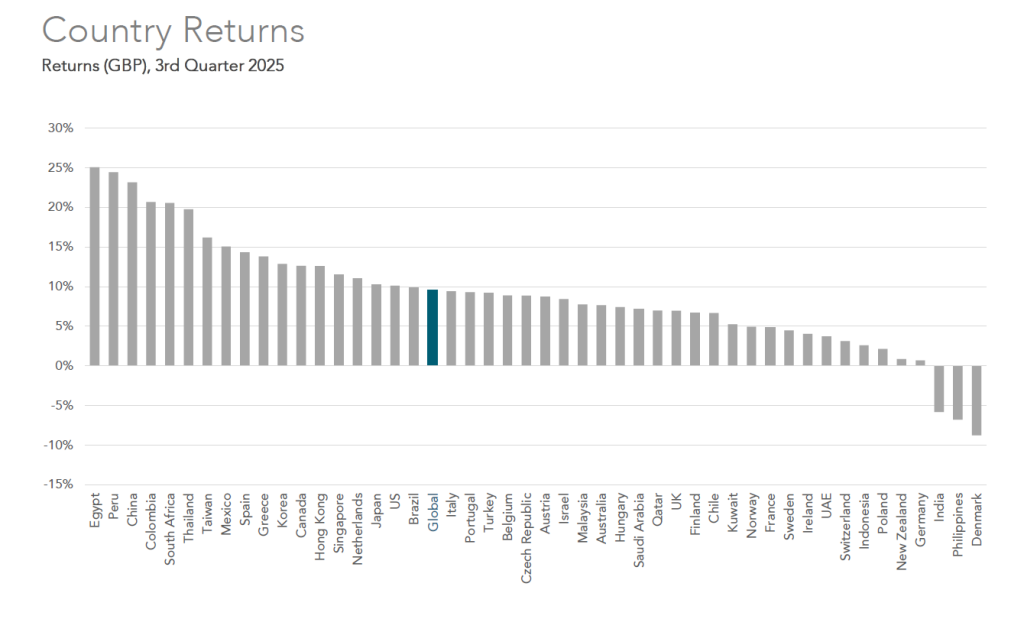

Quarterly Market Review

2nd Quarter 2025

2nd Quarter 2025

Here's a breakdown of what happened last quarter. This is for those of you interested in aspects such as which countries returns were higher (Korea!) or whether Value / Large or Smaller companies performed better in the period. There is also a Long-Term Market Summary and Average Quarterly Returns for Stocks and Bonds going back 20 years!

This should provide comfort that maintaining a well-diversified investment approach, rather than making predictions about what will come next, is more reliable for your savings.

With this in mind we help develop carefully considered financial plans to achieve your life objectives for the future which is probably what matters more to you!

Risks : Buying Investments can involve risk. The value of your Investments and the income from them can go down as well as up and is not guaranteed at anytime. You may not get back the full amount you invested. Information on past performance is not a reliable indicator for future performance. This information is intended for educational purposes and should not be considered a recommendation to buy or sell a particular security. The views expressed here are subject to change without notice and we can’t accept any liability for any loss arising directly or indirectly from any use of it.

To discuss your financial requirements or obtain other information click below

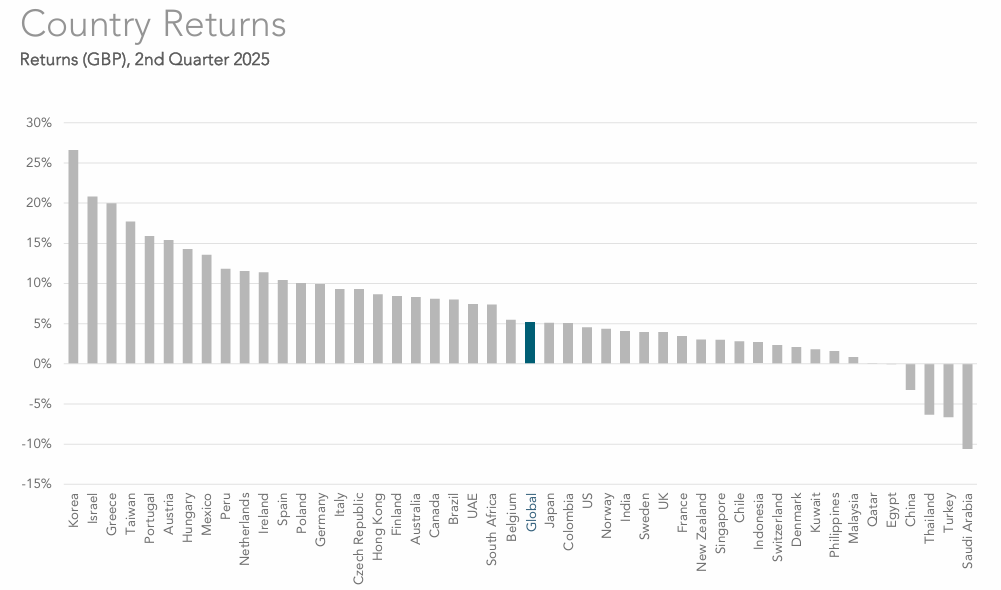

Quarterly Market Review

1st quarter 2025

Here's a breakdown of what happened last quarter. This is for those of you interested in aspects such as which countries returns were higher or whether Value / Growth or Smaller companies performed better in the period. I am aware that there have been many movements since April however for the purpose of completeness this covers the first quarter of the year.

This is also evidence that maintaining well-diversified, long-term thinking in your investment approach rather than reacting to daily valuations is key. We can help you develop and monitor carefully considered plans to meet your life objectives for the future which is probably more important to you!

Risks : Buying Investments can involve risk. The value of your Investments and the income from them can go down as well as up and is not guaranteed at anytime. You may not get back the full amount you invested. Information on past performance is not a reliable indicator for future performance. This information is intended for educational purposes and should not be considered a recommendation to buy or sell a particular security. The views expressed here are subject to change without notice and we can’t accept any liability for any loss arising directly or indirectly from any use of it.

To discuss your financial requirements or obtain other information click below

Chasing the returns of the biggest stocks in the US?

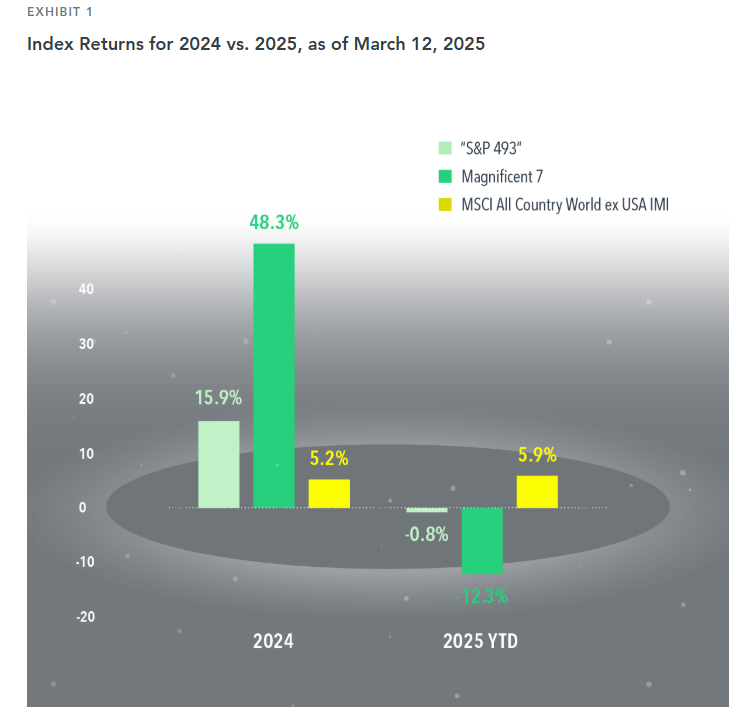

If top stocks exert a gravitational pull on the broad market’s return, the Magnificent 7 (Apple, Nvidia, Amazon, Tesla, Meta, Microsoft, Alphabet)have acted like the TON 618 black hole over the US the past few years.1 Accounting for about one-third of the S&P 500 Index’s weight2, the performance of these stocks has been a big driver of market-capitalization-weighted US large cap stock index returns.

This force can pull in a positive or negative direction. In 2024, the S&P 500 returned 25.0%. This was driven heavily by the Magnificent 7, which returned 48.3%. The other 493 stocks in the index collectively returned 15.9%. This year, the opposite effect has played out: The Magnificent 7 returned –12.3% through March 12, compared to –0.8% for the “S&P 493.”

The swings in performance for a US large cap index make a compelling case for global all cap diversification, which helps lessen exposure to the Magnificent 7. While non-US stocks underperformed the US in 2024, the MSCI All Country World ex USA IMI Index is outpacing the US thus far in 2025. Diversifying across regions and market capitalization is one way to mitigate the impact of a handful of stocks.

Risks : Buying Investments can involve risk. The value of your Investments and the income from them can go down as well as up and is not guaranteed at anytime. You may not get back the full amount you invested. Information on past performance is not a reliable indicator for future performance. This information is intended for educational purposes and should not be considered a recommendation to buy or sell a particular security. The views expressed here are subject to change without notice and we can’t accept any liability for any loss arising directly or indirectly from any use of it.

To discuss your financial requirements or obtain other information click below

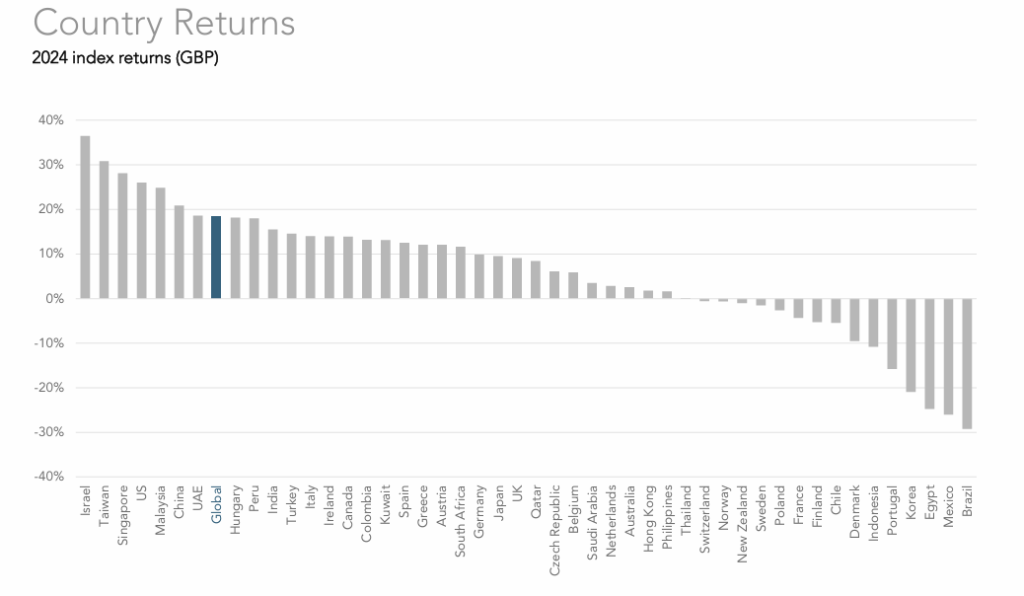

Annual Market Review 2024

Here's a breakdown of what happened in 2024 . This is for those of you interested in aspects such as which countries returns were higher or whether Value / Growth or Smaller companies performed better in the period.

This is also evidence that maintaining well-diversified, long-term thinking in your investment approach rather than reacting to market swings is key. We can help you develop and monitor carefully considered plans to meet your life objectives for the future which is probably more important to you!

Risks : Buying Investments can involve risk. The value of your Investments and the income from them can go down as well as up and is not guaranteed at anytime. You may not get back the full amount you invested. Information on past performance is not a reliable indicator for future performance. This information is intended for educational purposes and should not be considered a recommendation to buy or sell a particular security. The views expressed here are subject to change without notice and we can’t accept any liability for any loss arising directly or indirectly from any use of it.

To discuss your financial requirements or obtain other information click below

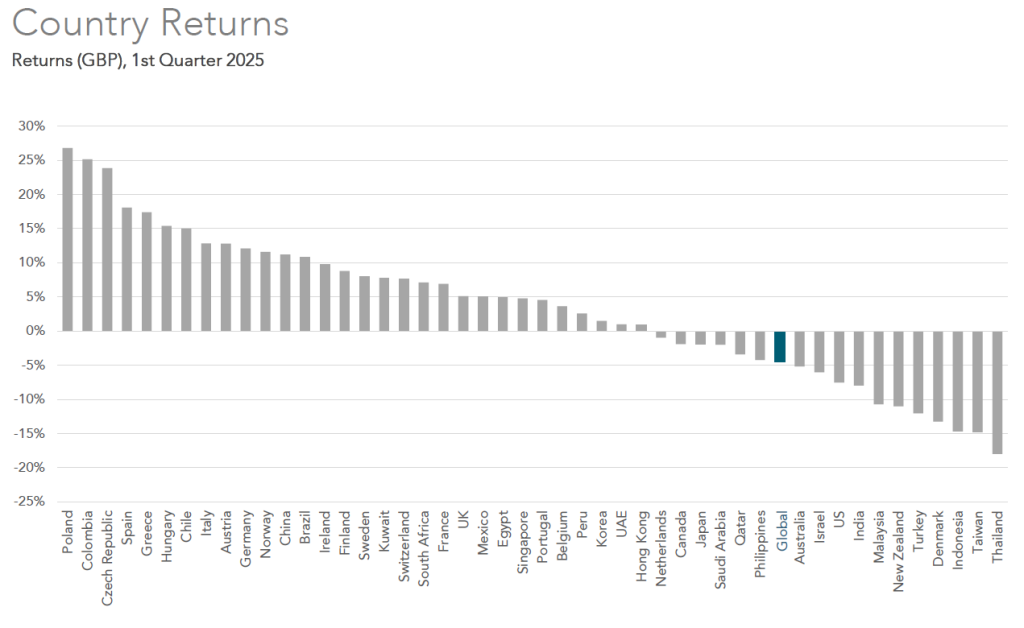

2022 Investment Summary