EARLY GIFTING OF PART OF YOUR INHERITANCE

TO A FAMILY MEMBER

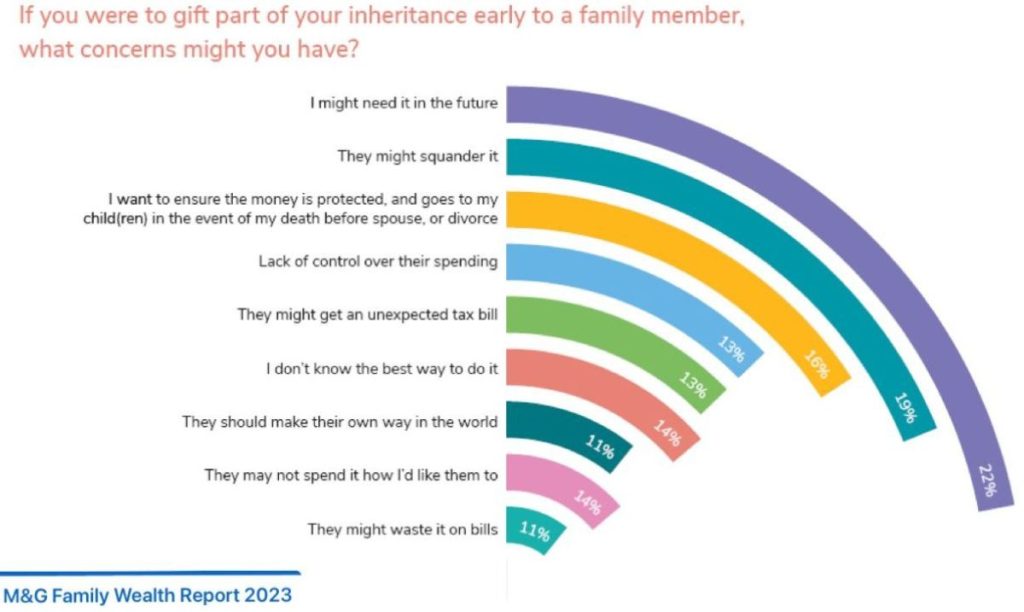

If you were to gift part of your inheritance early to a family member what concerns might you have? An estimated £5.5 trillion will be passed between generations over the next 30 years and the biggest concerns that come up are illustrated below For those looking for a bit more control and flexibility, let’s chat about how we can help

HALF-TIME: WINNERS AND LOSERS

The challenges of forecasting winners and losers can be futile – and I’m not talking about the Olympics here! It is interesting to note who is winning and who is behind at half-time in 2021 when it comes to investment returns from different assets. Who would have predicted commodities leading the way having finished in the relegation places in 8 of the last 9 years?

This is why we recommend a dependable long-term plan or framework for clients, ensuring effective diversification to meet individual objectives.

FINANCIAL RESOLUTIONS

WELCOME TO 2020! WHAT ARE YOUR PLANS FOR THE NEW DECADE

What does Wealth look like to you?

We all have different goals and aspirations in life

Cash is not king when it comes to long term goals

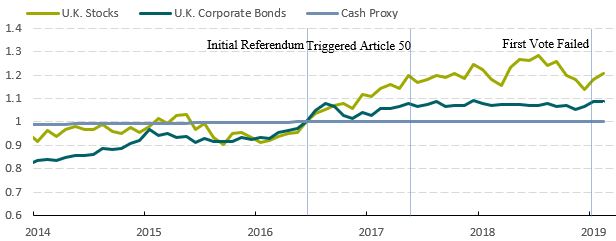

Source: Morningstar Investment Management calculation, Morningstar Direct data to 28 February 2019. Returns are month-end data points in GBP and normalised at 1 on 30 June 2016. Past performance is not a guide to future returns.

Given the recent string of events, I wanted to take this opportunity to comment on Brexit. Beyond the daily (or hourly) swings in prices, we can see UK company shares are up around 20.6% since the initial vote (in aggregate including dividends), UK corporate bonds are up 8.5% and cash has gone sideways. This can be seen in the chart above

So, looking backwards, it would have been a mistake to put your money under the pillow. Looking forward, it’s likely to be a mistake too. Here is an interesting thought - UK shares have beaten cash in every 20-year period in its history.

We normally recommend your savings are spread across many different assets and regions to diversify your returns and reduce risk —with the aim of meeting your own specific plans for the future.