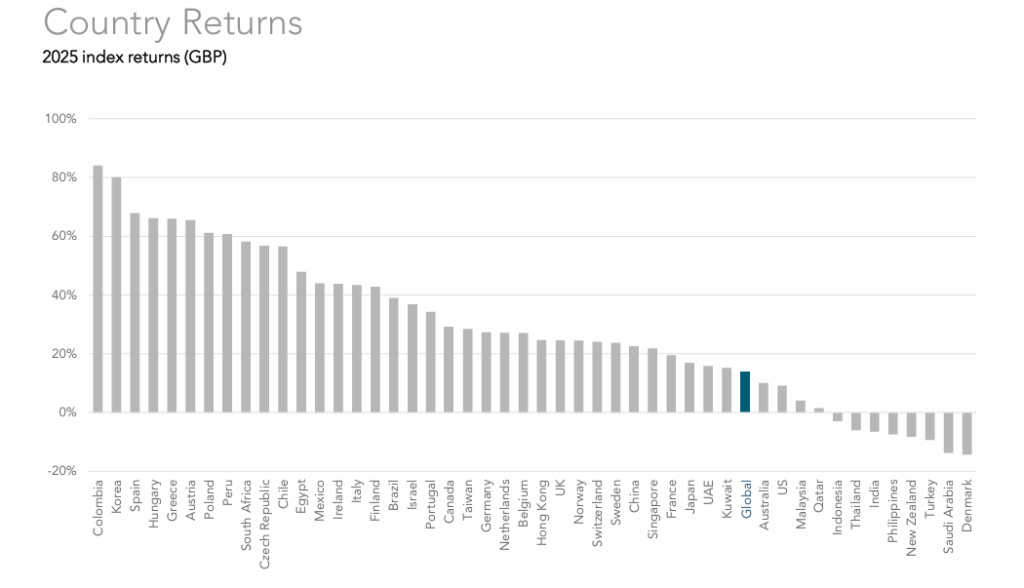

Annual Market Review 2025

So in the end after all the uncertainty (Trump's trade tariffs in April and the shift in US Trade Policy among other developments) let's look at 2025. Most investors are much better off than those sitting in cash on deposit. If you want to know which countries returns were higher and was it Emerging markets/ Value / Growth or Smaller companies that performed better in the period please see attached for the answers together with information on interest rates.

This is also evidence that maintaining well-diversified, long-term thinking in your investment approach rather than reacting to short term valuations is essential. As it happened you would have been better off buying the dip in valuations in April!

Risks : Buying Investments can involve risk. The value of your Investments and the income from them can go down as well as up and is not guaranteed at anytime. You may not get back the full amount you invested. Information on past performance is not a reliable indicator for future performance. This information is intended for educational purposes and should not be considered a recommendation to buy or sell a particular security. The views expressed here are subject to change without notice and we can’t accept any liability for any loss arising directly or indirectly from any use of it.

To discuss your financial requirements or obtain other information click below

Quarterly Market Review

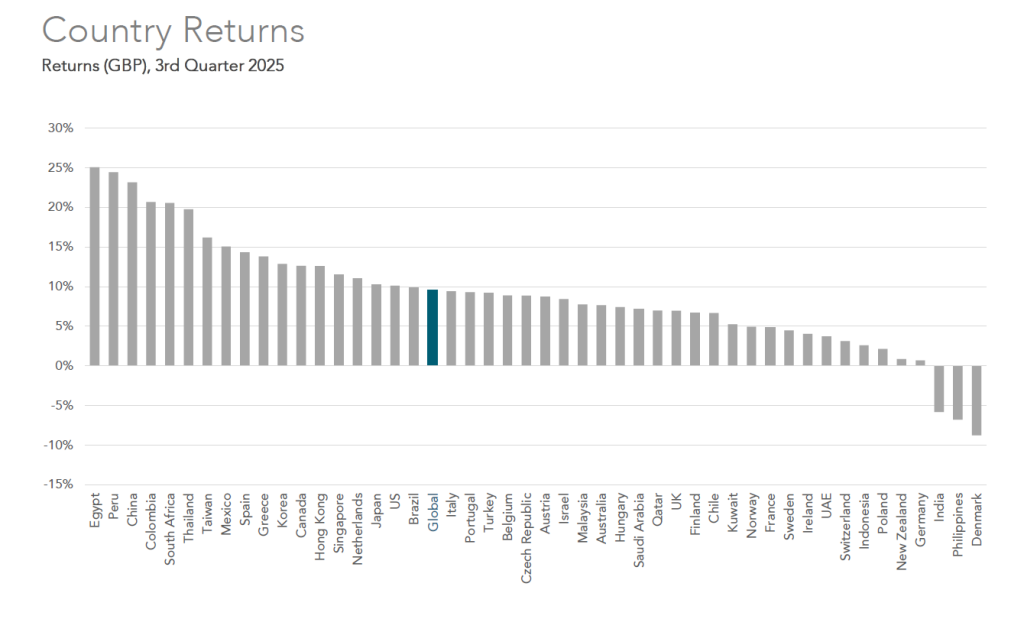

3rd Quarter 2025

3rd Quarter 2025

Here's a breakdown of what happened last quarter. This is for those of you interested in aspects such as which countries returns were higher and whether it was Value / Growth or Smaller companies that performed better in the period.

This is also evidence that maintaining well-diversified, long-term thinking in your investment approach rather than reacting to short term valuations is key. We can help you develop and monitor carefully considered plans to meet your life objectives for the future which is probably more important to you.

Happy Diwali!

Risks : Buying Investments can involve risk. The value of your Investments and the income from them can go down as well as up and is not guaranteed at anytime. You may not get back the full amount you invested. Information on past performance is not a reliable indicator for future performance. This information is intended for educational purposes and should not be considered a recommendation to buy or sell a particular security. The views expressed here are subject to change without notice and we can’t accept any liability for any loss arising directly or indirectly from any use of it.

To discuss your financial requirements or obtain other information click below

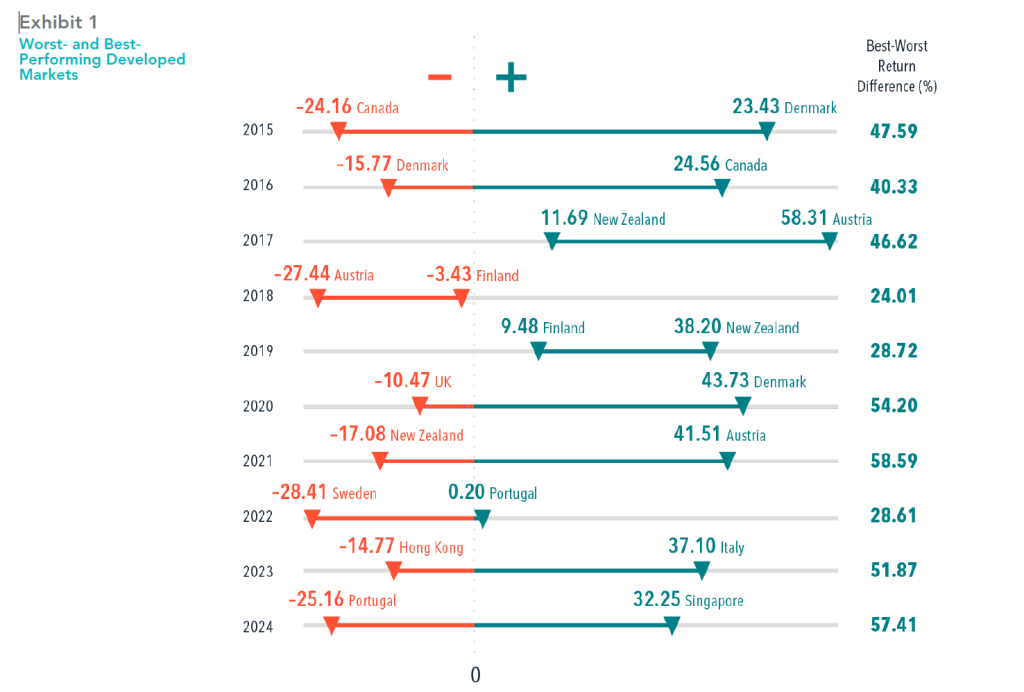

Mind the Gap - Diversifying Across Countries

While many of us enjoy an international holiday this summer it might be timely to talk about countries!

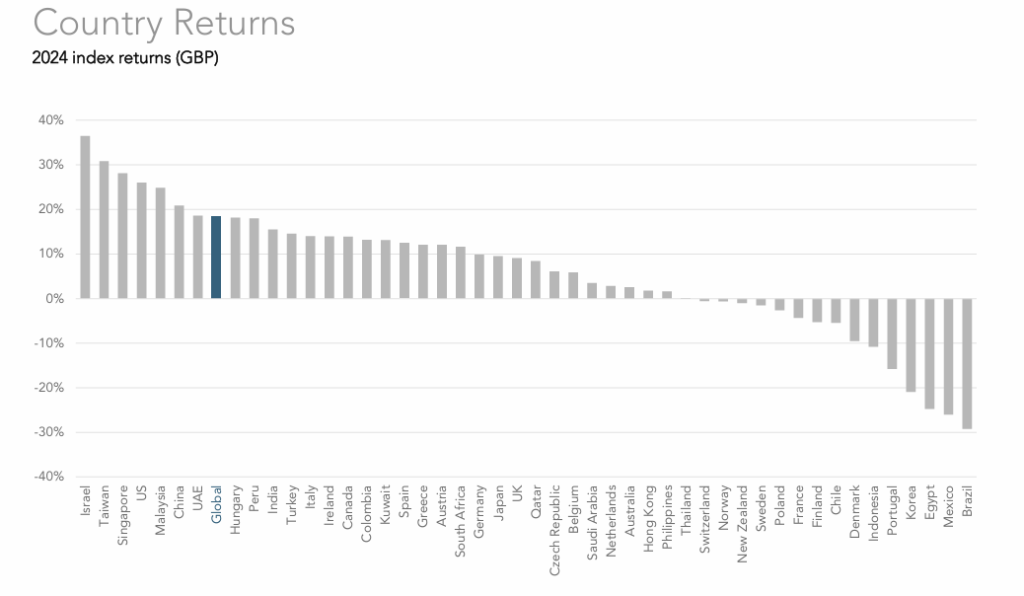

Recently, there’s been a lot of noise around which country one should invest their savings in for the best growth, and the idea of allocating away from the US for many reasons. In the first half of 2025, developed markets outside the US returned 19.0%, outperforming the US and emerging markets. But that outcome masks the wide range of returns across individual countries, from Spain’s 43.0% to Denmark at −5.5%. This kind of dispersion isn’t unusual—it’s a defining characteristic of global investing.

On average, the difference in return between the best- and worst-performing country

exceeded 43% over the past 10 calendar years. It’s no wonder investors may be tempted to chase recent winners or try to avoid losers. However, there’s little evidence that timing strategies consistently pay off. Country returns can turn quickly. For example, Canada posted the worst returns in 2015, down over 24%, but was the top performer in 2016, up over 24%. An investor who lost patience at the end of 2015 potentially missed out on the subsequent market recovery.

Country volatility is a normal part of global investing. Fortunately, as 2025 illustrates,

investors in a globally diversified portfolio can benefit from international diversification

without risking getting on the wrong side of country swings.

In USD. The US is included in the developed markets analysis. MSCI data © MSCI 2025, all rights reserved. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Risks : Buying Investments can involve risk. The value of your Investments and the income from them can go down as well as up and is not guaranteed at anytime. You may not get back the full amount you invested. Information on past performance is not a reliable indicator for future performance. This information is intended for educational purposes and should not be considered a recommendation to buy or sell a particular security. The views expressed here are subject to change without notice and we can’t accept any liability for any loss arising directly or indirectly from any use of it.

To discuss your financial requirements or obtain other information click below

Share this article with your friends by clicking below

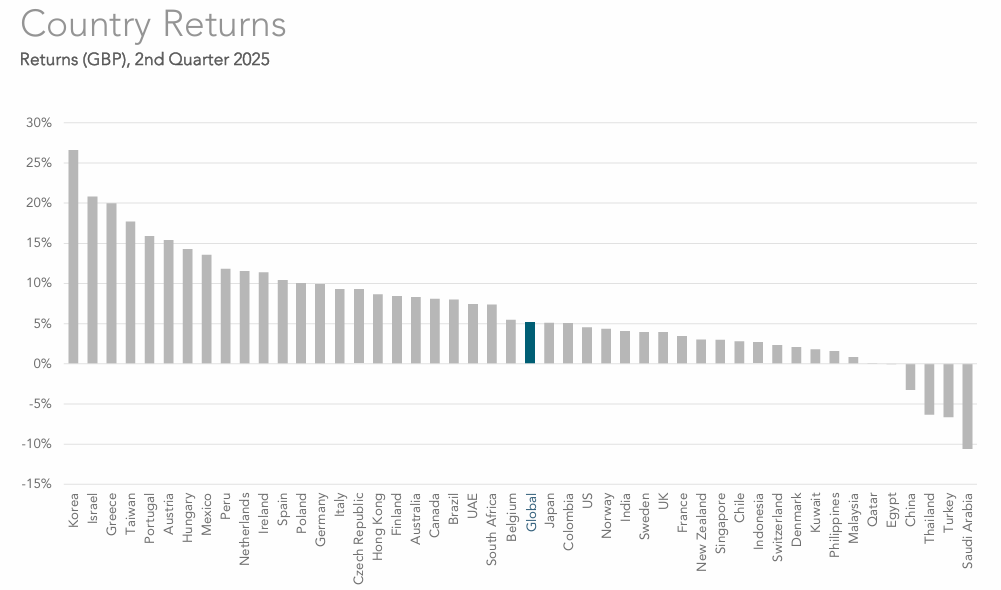

Quarterly Market Review

2nd Quarter 2025

2nd Quarter 2025

Here's a breakdown of what happened last quarter. This is for those of you interested in aspects such as which countries returns were higher (Korea!) or whether Value / Large or Smaller companies performed better in the period. There is also a Long-Term Market Summary and Average Quarterly Returns for Stocks and Bonds going back 20 years!

This should provide comfort that maintaining a well-diversified investment approach, rather than making predictions about what will come next, is more reliable for your savings.

With this in mind we help develop carefully considered financial plans to achieve your life objectives for the future which is probably what matters more to you!

Risks : Buying Investments can involve risk. The value of your Investments and the income from them can go down as well as up and is not guaranteed at anytime. You may not get back the full amount you invested. Information on past performance is not a reliable indicator for future performance. This information is intended for educational purposes and should not be considered a recommendation to buy or sell a particular security. The views expressed here are subject to change without notice and we can’t accept any liability for any loss arising directly or indirectly from any use of it.

To discuss your financial requirements or obtain other information click below

Market Insight: Sweeping changes

Welcome to our latest issue. The October 2024 Budget proposed sweeping changes to Inheritance Tax (IHT), significantly tightening the laws that were previously more forgiving for families with trading businesses and farmland. Effective from April 2026, these types of assets will now incur IHT at a reduced rate of 20% on valuations exceeding £1 million. On page 04, we consider why the changes are leaving many families scrambling to reassess their estate planning strategies.

Ten years ago, pension freedoms revolutionised how people access their retirement savings. These changes offered savers over 55 greater options to withdraw and manage their pension pots. However, a decade later, research indicates that many individuals are making critical financial decisions without seeking advice or fully understanding the tax implications. Read the full article on page 03.

A complete list of the articles featured in this issue appears on page 02.

Risks : Buying Investments can involve risk. The value of your Investments and the income from them can go down as well as up and is not guaranteed at anytime. You may not get back the full amount you invested. Information on past performance is not a reliable indicator for future performance. This information is intended for educational purposes and should not be considered a recommendation to buy or sell a particular security. The views expressed here are subject to change without notice and we can’t accept any liability for any loss arising directly or indirectly from any use of it.

To discuss your financial requirements or obtain other information click below

Quarterly Market Review

1st quarter 2025

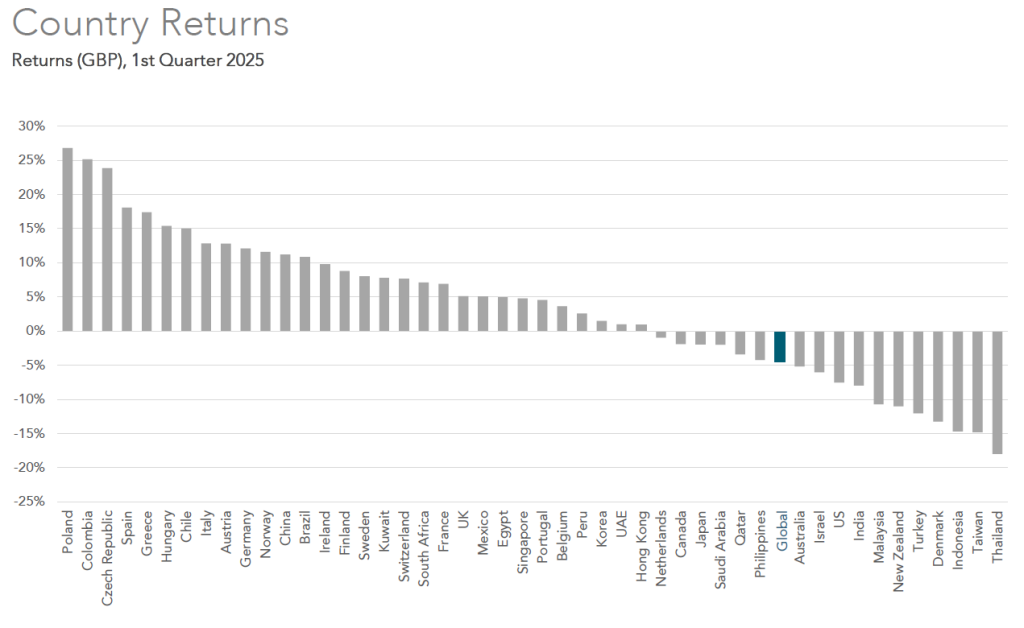

Here's a breakdown of what happened last quarter. This is for those of you interested in aspects such as which countries returns were higher or whether Value / Growth or Smaller companies performed better in the period. I am aware that there have been many movements since April however for the purpose of completeness this covers the first quarter of the year.

This is also evidence that maintaining well-diversified, long-term thinking in your investment approach rather than reacting to daily valuations is key. We can help you develop and monitor carefully considered plans to meet your life objectives for the future which is probably more important to you!

Risks : Buying Investments can involve risk. The value of your Investments and the income from them can go down as well as up and is not guaranteed at anytime. You may not get back the full amount you invested. Information on past performance is not a reliable indicator for future performance. This information is intended for educational purposes and should not be considered a recommendation to buy or sell a particular security. The views expressed here are subject to change without notice and we can’t accept any liability for any loss arising directly or indirectly from any use of it.

To discuss your financial requirements or obtain other information click below

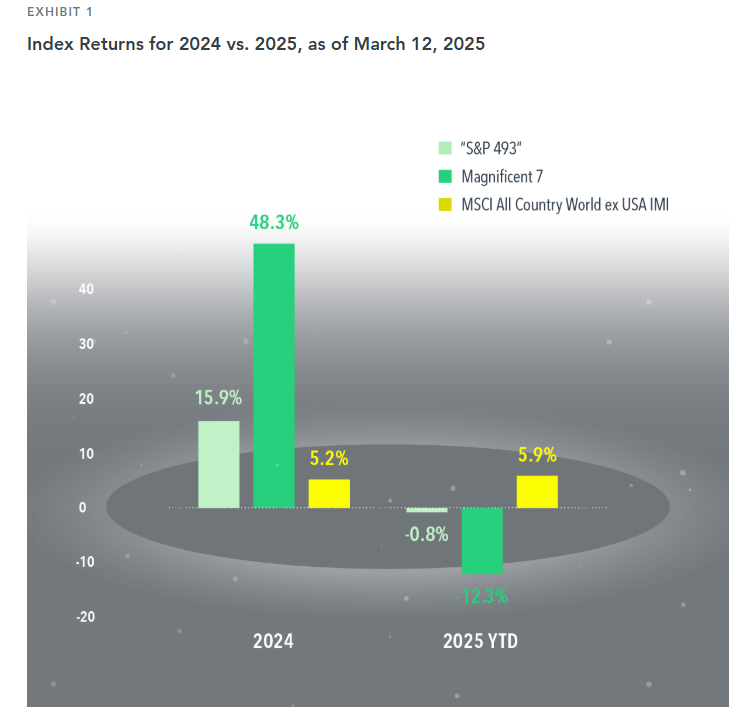

Chasing the returns of the biggest stocks in the US?

If top stocks exert a gravitational pull on the broad market’s return, the Magnificent 7 (Apple, Nvidia, Amazon, Tesla, Meta, Microsoft, Alphabet)have acted like the TON 618 black hole over the US the past few years.1 Accounting for about one-third of the S&P 500 Index’s weight2, the performance of these stocks has been a big driver of market-capitalization-weighted US large cap stock index returns.

This force can pull in a positive or negative direction. In 2024, the S&P 500 returned 25.0%. This was driven heavily by the Magnificent 7, which returned 48.3%. The other 493 stocks in the index collectively returned 15.9%. This year, the opposite effect has played out: The Magnificent 7 returned –12.3% through March 12, compared to –0.8% for the “S&P 493.”

The swings in performance for a US large cap index make a compelling case for global all cap diversification, which helps lessen exposure to the Magnificent 7. While non-US stocks underperformed the US in 2024, the MSCI All Country World ex USA IMI Index is outpacing the US thus far in 2025. Diversifying across regions and market capitalization is one way to mitigate the impact of a handful of stocks.

Risks : Buying Investments can involve risk. The value of your Investments and the income from them can go down as well as up and is not guaranteed at anytime. You may not get back the full amount you invested. Information on past performance is not a reliable indicator for future performance. This information is intended for educational purposes and should not be considered a recommendation to buy or sell a particular security. The views expressed here are subject to change without notice and we can’t accept any liability for any loss arising directly or indirectly from any use of it.

To discuss your financial requirements or obtain other information click below

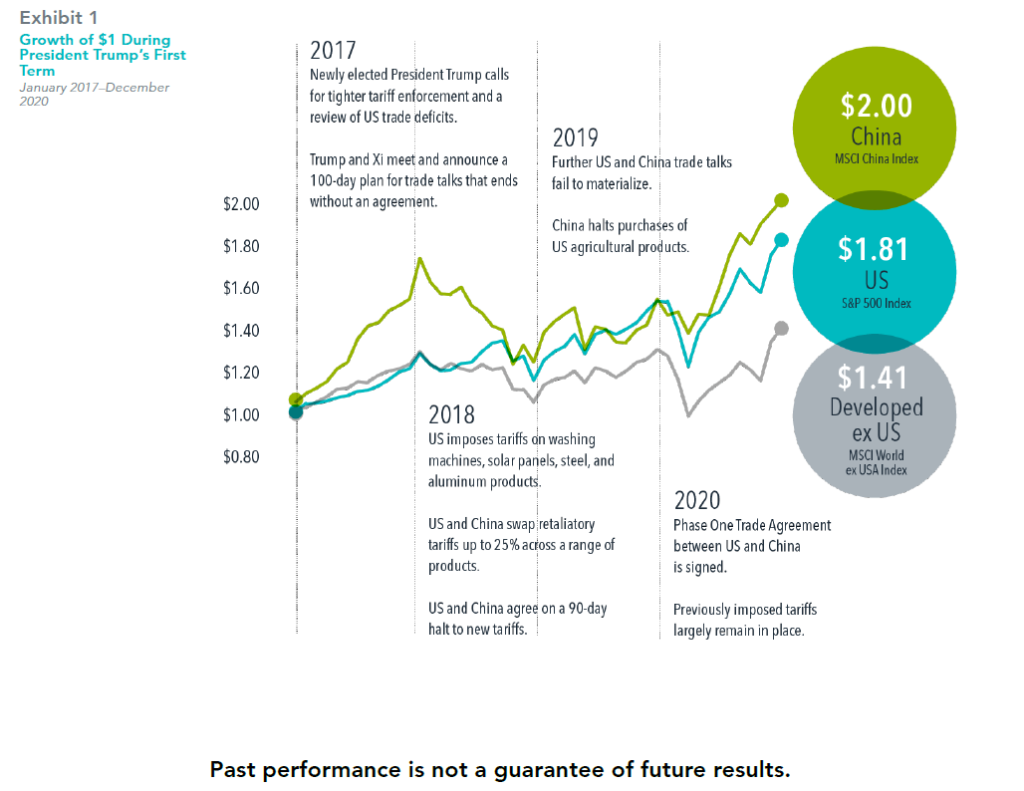

MARKET INSIGHTS: Tariff Trepidation

One of the focal points following the presidential election is the potential for an increase in tariffs applied to goods produced outside the US. Perhaps you have wondered what this could mean for your investments.

One period offering perspective on this issue is President Trump’s first term in office. Beginning in 2017, the administration eyed China as a target and, by 2018, began imposing tariffs across a range of products. The next couple of years saw back and forth trade discussions that eventually led to an agreement, though pre-existing tariffs remained in place. Despite all this uncertainty, both China and the US posted higher cumulative returns than the MSCI World ex USA Index over the four years of Trump’s term.

Markets are forward-looking, and the economic impact from initiatives such as tariffs is likely already reflected in current market prices. When these expected developments come to pass, the effect on markets and your investments may be muted.

In USD. Data shown from January 1, 2017, to December 31, 2020. Growth of wealth shows the growth of a hypothetical

investment of $1. Data presented in the growth of wealth chart is hypothetical and assumes reinvestment of income and no

transaction costs or taxes. The chart is for illustrative purposes only and is not indicative of any investment. Performance

includes reinvestment of dividends and capital gains. MSCI China Index and MSCI World ex USA Index returns are net

dividend.

Tariff events data sourced from Reuters. S&P data © 2025 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. MSCI data © MSCI 2025, all rights reserved.

Indices are not available for direct investment: therefore their performance does not reflect the expenses associated with the management of an actual portfolio

Tariff events data sourced from Reuters. S&P data © 2025 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. MSCI data © MSCI 2025, all rights reserved.

Indices are not available for direct investment: therefore their performance does not reflect the expenses associated with the management of an actual portfolio

Risks : Buying Investments can involve risk. The value of your Investments and the income from them can go down as well as up and is not guaranteed at anytime. You may not get back the full amount you invested. Information on past performance is not a reliable indicator for future performance. This information is intended for educational purposes and should not be considered a recommendation to buy or sell a particular security. The views expressed here are subject to change without notice and we can’t accept any liability for any loss arising directly or indirectly from any use of it.

To discuss your financial requirements or obtain other information click below

Share this article with your friends by clicking below

MARKET INSIGHTS: CAN YOU AFFORD NOT TO BE INVESTED?

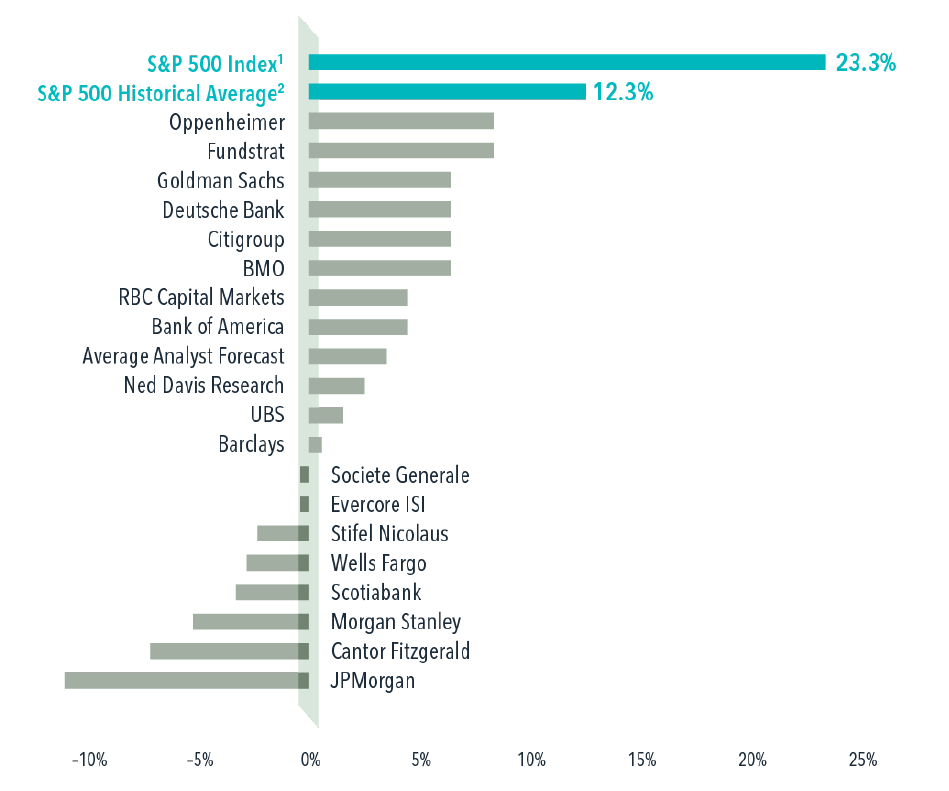

Following on from my note earlier in the month here’s another detailed infographic on the problem of trying to predict returns or thinking it’s better to wait and choose the right time to make your investments. Although this example refers to the US Stock Market (the largest by size in the world) it can apply to many investment choices and indeed could be related to other aspects of life when it comes to predictions!

The S&P 500 Index rose by 23.3% in 2024. This far exceeded expectations from analysts polled at the end of 2023, none of whom believed the S&P would grow by its historical average rate of return,12.3%. In fact, nearly half of the analysts predicted a negative year for the index. If someone listened to those analysts they may have waited and not invested or divested from US stocks and lost out on the returns.

This dispersion in predictions highlights the challenge with making asset allocation decisions based on forecasts. Individuals arrive at different expectations because they may see the world differently. Hence we prefer to look at the evidence of returns over longer periods and consider spreading investments across a range of assets focusing on what you can control to meet your planning goals which is where we can help.

The S&P 500 Index rose by 23.3% in 2024. This far exceeded expectations from analysts polled at the end of 2023, none of whom believed the S&P would grow by its historical average rate of return,12.3%. In fact, nearly half of the analysts predicted a negative year for the index. If someone listened to those analysts they may have waited and not invested or divested from US stocks and lost out on the returns.

This dispersion in predictions highlights the challenge with making asset allocation decisions based on forecasts. Individuals arrive at different expectations because they may see the world differently. Hence we prefer to look at the evidence of returns over longer periods and consider spreading investments across a range of assets focusing on what you can control to meet your planning goals which is where we can help.

Predictions Gone Wrong: Equity analyst predictions vs. actual for the S&P 500

Index calendar year return in 2024

1. Price-only return.

2. Based on actual S&P 500 Index average annual total return from 1927 to 2024.In USD.

2. Based on actual S&P 500 Index average annual total return from 1927 to 2024.In USD.

Source: Bloomberg, using the “Strategists S&P 500 Index Estimates for Year-End 2024” as of December 19, 2023

Analyst forecasts and 2024 return are price returns. S&P data © 2025 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio.

Risks : Buying Investments can involve risk. The value of your Investments and the income from them can go down as well as up and is not guaranteed at anytime. You may not get back the full amount you invested. Information on past performance is not a reliable indicator for future performance. This information is intended for educational purposes and should not be considered a recommendation to buy or sell a particular security. The views expressed here are subject to change without notice and we can’t accept any liability for any loss arising directly or indirectly from any use of it.

Risks : Buying Investments can involve risk. The value of your Investments and the income from them can go down as well as up and is not guaranteed at anytime. You may not get back the full amount you invested. Information on past performance is not a reliable indicator for future performance. This information is intended for educational purposes and should not be considered a recommendation to buy or sell a particular security. The views expressed here are subject to change without notice and we can’t accept any liability for any loss arising directly or indirectly from any use of it.

To discuss your financial requirements or obtain other information click below

Share this article with your friends by clicking below

Annual Market Review 2024

Here's a breakdown of what happened in 2024 . This is for those of you interested in aspects such as which countries returns were higher or whether Value / Growth or Smaller companies performed better in the period.

This is also evidence that maintaining well-diversified, long-term thinking in your investment approach rather than reacting to market swings is key. We can help you develop and monitor carefully considered plans to meet your life objectives for the future which is probably more important to you!

Risks : Buying Investments can involve risk. The value of your Investments and the income from them can go down as well as up and is not guaranteed at anytime. You may not get back the full amount you invested. Information on past performance is not a reliable indicator for future performance. This information is intended for educational purposes and should not be considered a recommendation to buy or sell a particular security. The views expressed here are subject to change without notice and we can’t accept any liability for any loss arising directly or indirectly from any use of it.

To discuss your financial requirements or obtain other information click below