EARLY GIFTING OF PART OF YOUR INHERITANCE

TO A FAMILY MEMBER

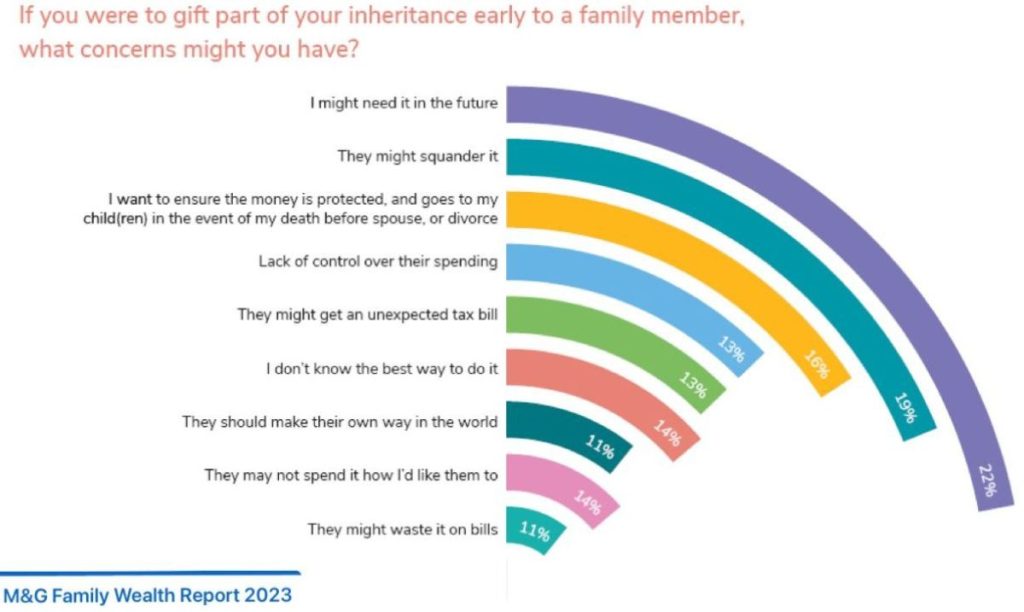

If you were to gift part of your inheritance early to a family member what concerns might you have? An estimated £5.5 trillion will be passed between generations over the next 30 years and the biggest concerns that come up are illustrated below For those looking for a bit more control and flexibility, let’s chat about how we can help

COLERIDGE CAPITAL MODEL PORTFOLIO SERVICE

We are delighted to announce that we have formed an Investment Committee and Model Portfolio Service with M&G for the benefit of our clients.

Given the dynamic nature of the market at this time we want to make sure our clients benefit from making revisions to their portfolios on a regular basis. Our Model Portfolio Service will allow for automatic changes to fund managers and investment allocation to manage the level of risk and returns agreed with you. Our existing clients can opt for this service without incurring costs for the revision.

Economic factors as well as fund managers should be closely monitored. We believe that leveraging the resources, scale and research teams of M&G, who manage £370 Billion, will further improve our services.

Of course we continue to retain our status as an Independent Financial Adviser so can make and tailor any solutions to suit your individual requirements, preferences and objectives.

THE NOT SO MINI BUDGET

Kwasi Kwarteng definitely hit the ground running with the largest tax cuts in a Budget since Anthony Barber 50 years ago!

He’s scrapped the 45% top rate of income tax, reduced the Basic Rate of tax (from 20% to 19% from April 2023) abolished the cap on bankers’ bonuses and reversed the recent National Insurance rise which was proposed to fund health and social care. There will also be cuts to Dividend taxes. A lot of the changes favour higher earners.

This has led to a slide in the value of the Great British Pound, and the cost of borrowing looks set to increase. The idea is that the mini-budget stimulates the economy. Let’s wait and see.

We know you’ll have different priorities for your wealth at different points in your life. Whatever your financial aims, we can help you achieve them.

COVID: WORKING FROM HOME

As we manage the challenges raised by Cov-19, we are writing to inform you that as a responsible employer we will be implementing working from home procedures immediately in line with Government guidelines.

Open For Business

Whilst there remains much uncertainty regarding the duration of the current Government guidelines, we would like to reassure all of our clients that we remain fully open for business during this period. If you have any questions regarding either new or existing investments, just let us know by contacting us and we will be delighted to help.

FINANCIAL RESOLUTIONS

WELCOME TO 2020! WHAT ARE YOUR PLANS FOR THE NEW DECADE

What does Wealth look like to you?

We all have different goals and aspirations in life

Cash is not king when it comes to long term goals

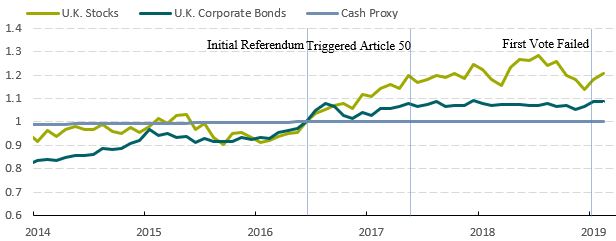

Source: Morningstar Investment Management calculation, Morningstar Direct data to 28 February 2019. Returns are month-end data points in GBP and normalised at 1 on 30 June 2016. Past performance is not a guide to future returns.

Given the recent string of events, I wanted to take this opportunity to comment on Brexit. Beyond the daily (or hourly) swings in prices, we can see UK company shares are up around 20.6% since the initial vote (in aggregate including dividends), UK corporate bonds are up 8.5% and cash has gone sideways. This can be seen in the chart above

So, looking backwards, it would have been a mistake to put your money under the pillow. Looking forward, it’s likely to be a mistake too. Here is an interesting thought - UK shares have beaten cash in every 20-year period in its history.

We normally recommend your savings are spread across many different assets and regions to diversify your returns and reduce risk —with the aim of meeting your own specific plans for the future.