Market Insight: Sweeping changes

Welcome to our latest issue. The October 2024 Budget proposed sweeping changes to Inheritance Tax (IHT), significantly tightening the laws that were previously more forgiving for families with trading businesses and farmland. Effective from April 2026, these types of assets will now incur IHT at a reduced rate of 20% on valuations exceeding £1 million. On page 04, we consider why the changes are leaving many families scrambling to reassess their estate planning strategies.

Ten years ago, pension freedoms revolutionised how people access their retirement savings. These changes offered savers over 55 greater options to withdraw and manage their pension pots. However, a decade later, research indicates that many individuals are making critical financial decisions without seeking advice or fully understanding the tax implications. Read the full article on page 03.

A complete list of the articles featured in this issue appears on page 02.

Risks : Buying Investments can involve risk. The value of your Investments and the income from them can go down as well as up and is not guaranteed at anytime. You may not get back the full amount you invested. Information on past performance is not a reliable indicator for future performance. This information is intended for educational purposes and should not be considered a recommendation to buy or sell a particular security. The views expressed here are subject to change without notice and we can’t accept any liability for any loss arising directly or indirectly from any use of it.

To discuss your financial requirements or obtain other information click below

Chasing the returns of the biggest stocks in the US?

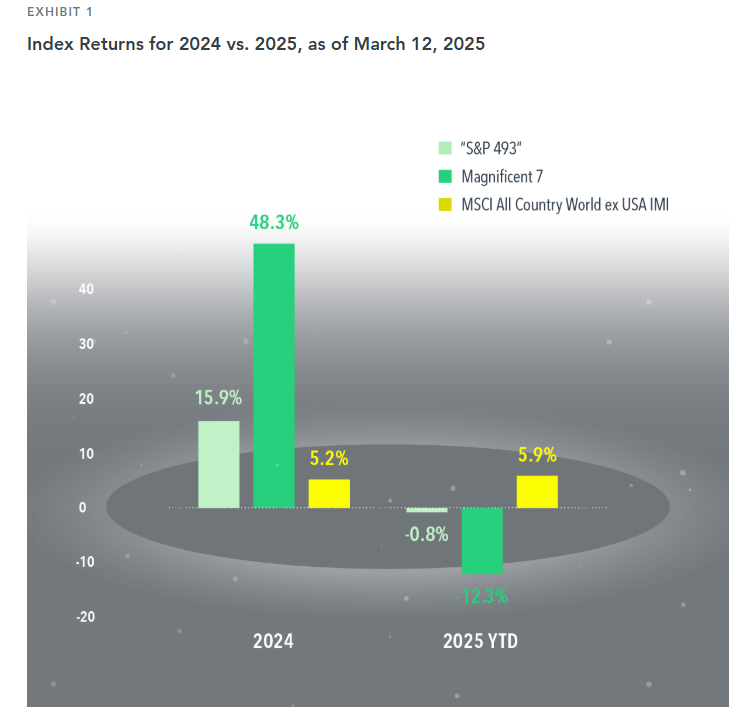

If top stocks exert a gravitational pull on the broad market’s return, the Magnificent 7 (Apple, Nvidia, Amazon, Tesla, Meta, Microsoft, Alphabet)have acted like the TON 618 black hole over the US the past few years.1 Accounting for about one-third of the S&P 500 Index’s weight2, the performance of these stocks has been a big driver of market-capitalization-weighted US large cap stock index returns.

This force can pull in a positive or negative direction. In 2024, the S&P 500 returned 25.0%. This was driven heavily by the Magnificent 7, which returned 48.3%. The other 493 stocks in the index collectively returned 15.9%. This year, the opposite effect has played out: The Magnificent 7 returned –12.3% through March 12, compared to –0.8% for the “S&P 493.”

The swings in performance for a US large cap index make a compelling case for global all cap diversification, which helps lessen exposure to the Magnificent 7. While non-US stocks underperformed the US in 2024, the MSCI All Country World ex USA IMI Index is outpacing the US thus far in 2025. Diversifying across regions and market capitalization is one way to mitigate the impact of a handful of stocks.

Risks : Buying Investments can involve risk. The value of your Investments and the income from them can go down as well as up and is not guaranteed at anytime. You may not get back the full amount you invested. Information on past performance is not a reliable indicator for future performance. This information is intended for educational purposes and should not be considered a recommendation to buy or sell a particular security. The views expressed here are subject to change without notice and we can’t accept any liability for any loss arising directly or indirectly from any use of it.

To discuss your financial requirements or obtain other information click below

THE NOT SO MINI BUDGET

Kwasi Kwarteng definitely hit the ground running with the largest tax cuts in a Budget since Anthony Barber 50 years ago!

He’s scrapped the 45% top rate of income tax, reduced the Basic Rate of tax (from 20% to 19% from April 2023) abolished the cap on bankers’ bonuses and reversed the recent National Insurance rise which was proposed to fund health and social care. There will also be cuts to Dividend taxes. A lot of the changes favour higher earners.

This has led to a slide in the value of the Great British Pound, and the cost of borrowing looks set to increase. The idea is that the mini-budget stimulates the economy. Let’s wait and see.

We know you’ll have different priorities for your wealth at different points in your life. Whatever your financial aims, we can help you achieve them.