Market Insight: Sweeping changes

Welcome to our latest issue. The October 2024 Budget proposed sweeping changes to Inheritance Tax (IHT), significantly tightening the laws that were previously more forgiving for families with trading businesses and farmland. Effective from April 2026, these types of assets will now incur IHT at a reduced rate of 20% on valuations exceeding £1 million. On page 04, we consider why the changes are leaving many families scrambling to reassess their estate planning strategies.

Ten years ago, pension freedoms revolutionised how people access their retirement savings. These changes offered savers over 55 greater options to withdraw and manage their pension pots. However, a decade later, research indicates that many individuals are making critical financial decisions without seeking advice or fully understanding the tax implications. Read the full article on page 03.

A complete list of the articles featured in this issue appears on page 02.

Risks : Buying Investments can involve risk. The value of your Investments and the income from them can go down as well as up and is not guaranteed at anytime. You may not get back the full amount you invested. Information on past performance is not a reliable indicator for future performance. This information is intended for educational purposes and should not be considered a recommendation to buy or sell a particular security. The views expressed here are subject to change without notice and we can’t accept any liability for any loss arising directly or indirectly from any use of it.

To discuss your financial requirements or obtain other information click below

Chasing the returns of the biggest stocks in the US?

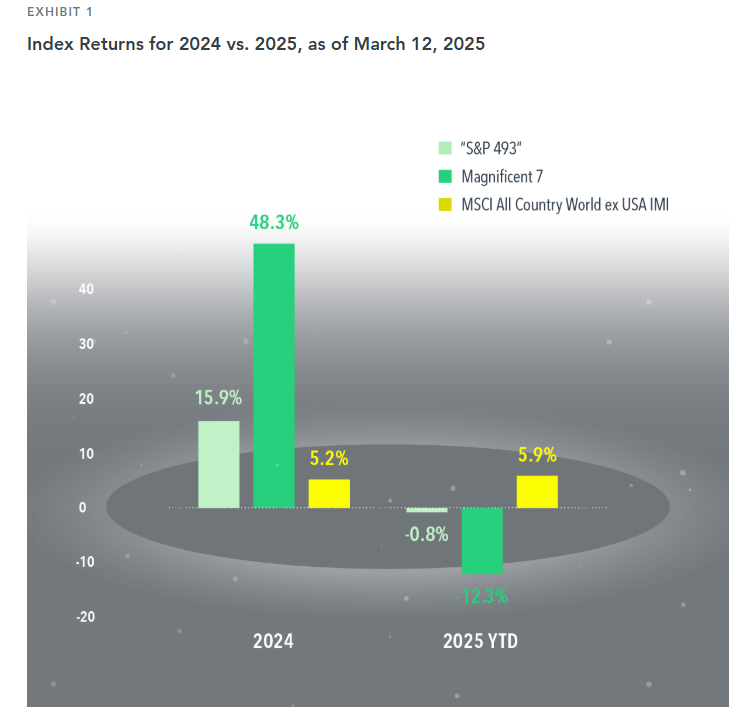

If top stocks exert a gravitational pull on the broad market’s return, the Magnificent 7 (Apple, Nvidia, Amazon, Tesla, Meta, Microsoft, Alphabet)have acted like the TON 618 black hole over the US the past few years.1 Accounting for about one-third of the S&P 500 Index’s weight2, the performance of these stocks has been a big driver of market-capitalization-weighted US large cap stock index returns.

This force can pull in a positive or negative direction. In 2024, the S&P 500 returned 25.0%. This was driven heavily by the Magnificent 7, which returned 48.3%. The other 493 stocks in the index collectively returned 15.9%. This year, the opposite effect has played out: The Magnificent 7 returned –12.3% through March 12, compared to –0.8% for the “S&P 493.”

The swings in performance for a US large cap index make a compelling case for global all cap diversification, which helps lessen exposure to the Magnificent 7. While non-US stocks underperformed the US in 2024, the MSCI All Country World ex USA IMI Index is outpacing the US thus far in 2025. Diversifying across regions and market capitalization is one way to mitigate the impact of a handful of stocks.

Risks : Buying Investments can involve risk. The value of your Investments and the income from them can go down as well as up and is not guaranteed at anytime. You may not get back the full amount you invested. Information on past performance is not a reliable indicator for future performance. This information is intended for educational purposes and should not be considered a recommendation to buy or sell a particular security. The views expressed here are subject to change without notice and we can’t accept any liability for any loss arising directly or indirectly from any use of it.

To discuss your financial requirements or obtain other information click below

MARKET INSIGHTS: Tariff Trepidation

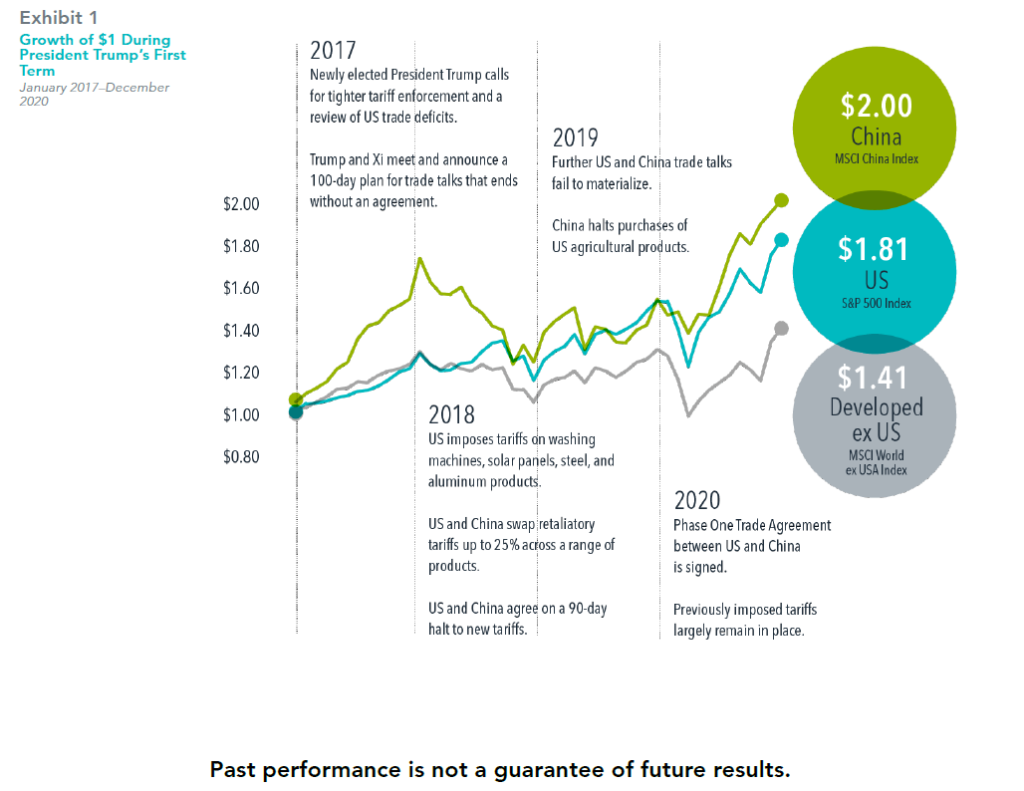

One of the focal points following the presidential election is the potential for an increase in tariffs applied to goods produced outside the US. Perhaps you have wondered what this could mean for your investments.

One period offering perspective on this issue is President Trump’s first term in office. Beginning in 2017, the administration eyed China as a target and, by 2018, began imposing tariffs across a range of products. The next couple of years saw back and forth trade discussions that eventually led to an agreement, though pre-existing tariffs remained in place. Despite all this uncertainty, both China and the US posted higher cumulative returns than the MSCI World ex USA Index over the four years of Trump’s term.

Markets are forward-looking, and the economic impact from initiatives such as tariffs is likely already reflected in current market prices. When these expected developments come to pass, the effect on markets and your investments may be muted.

In USD. Data shown from January 1, 2017, to December 31, 2020. Growth of wealth shows the growth of a hypothetical

investment of $1. Data presented in the growth of wealth chart is hypothetical and assumes reinvestment of income and no

transaction costs or taxes. The chart is for illustrative purposes only and is not indicative of any investment. Performance

includes reinvestment of dividends and capital gains. MSCI China Index and MSCI World ex USA Index returns are net

dividend.

Tariff events data sourced from Reuters. S&P data © 2025 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. MSCI data © MSCI 2025, all rights reserved.

Indices are not available for direct investment: therefore their performance does not reflect the expenses associated with the management of an actual portfolio

Tariff events data sourced from Reuters. S&P data © 2025 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. MSCI data © MSCI 2025, all rights reserved.

Indices are not available for direct investment: therefore their performance does not reflect the expenses associated with the management of an actual portfolio

Risks : Buying Investments can involve risk. The value of your Investments and the income from them can go down as well as up and is not guaranteed at anytime. You may not get back the full amount you invested. Information on past performance is not a reliable indicator for future performance. This information is intended for educational purposes and should not be considered a recommendation to buy or sell a particular security. The views expressed here are subject to change without notice and we can’t accept any liability for any loss arising directly or indirectly from any use of it.

To discuss your financial requirements or obtain other information click below

Share this article with your friends by clicking below

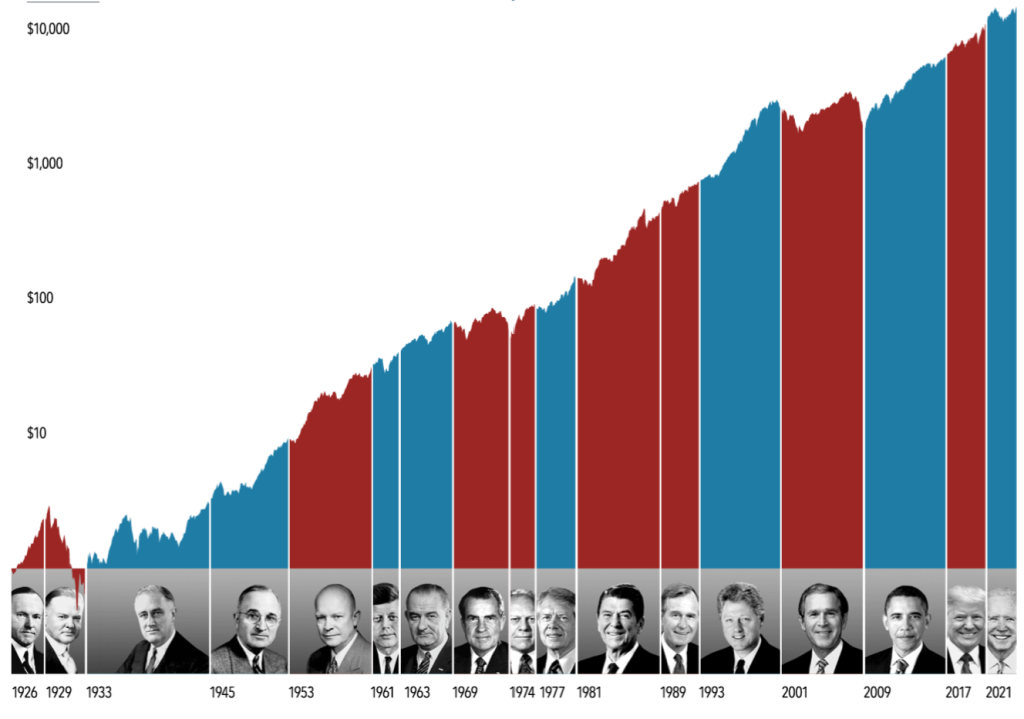

MARKET INSIGHTS: HOW MUCH INFLUENCE DOES THE US PRESIDENT HAVE ON US STOCKS?

In anticipation of tonight’s Presidential Debate there might be questions about how financial markets respond during elections. But the outcome of an election is only one of many inputs to the market. This exhibit examines market data for nearly 100 years of US presidential terms and shows a consistent upward march for US equities regardless of who’s in the Oval Office. This is an important lesson on the benefits of a long-term investment approach.

Growth of $1 1926-2023

This material is in relation to the US market and contains analysis specific to the US. In US dollars. Stock returns are represented by the S&P 500 Index. Source: S&P data © 2024 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved.

Data presented in the growth of $1 chart is hypothetical and assume reinvestment of income and no transaction costs or taxes.

The chart is for illustrative purposes only and is not indicative of any investment. Growth of wealth for the full sample from January 1, 1926, through December 31, 2023. Growth of wealth for each presidential term starts on the inauguration month of each president up to but not including the inauguration month of a successor. Growth of wealth for Calvin Coolidge's term starts on January 1, 1926, based on the inception date of the S&P 500 Index.

This material is in relation to the US market and contains analysis specific to the US. In US dollars. Stock returns are represented by the S&P 500 Index. Source: S&P data © 2024 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved.

Data presented in the growth of $1 chart is hypothetical and assume reinvestment of income and no transaction costs or taxes.

The chart is for illustrative purposes only and is not indicative of any investment. Growth of wealth for the full sample from January 1, 1926, through December 31, 2023. Growth of wealth for each presidential term starts on the inauguration month of each president up to but not including the inauguration month of a successor. Growth of wealth for Calvin Coolidge's term starts on January 1, 1926, based on the inception date of the S&P 500 Index.

Risks : Buying Investments can involve risk. The value of your Investments and the income from them can go down as well as up and is not guaranteed at anytime. You may not get back the full amount you invested. Information on past performance is not a reliable indicator for future performance. This information is intended for educational purposes and should not be considered a recommendation to buy or sell a particular security. The views expressed here are subject to change without notice and we can’t accept any liability for any loss arising directly or indirectly from any use of it.

To discuss your financial requirements or obtain other information click below

EVEN THE SMARTEST PEOPLE GET IT GROSSLY WRONG

As you are undoubtedly aware, the U.K. election has been announced for December 12th. This is likely to be the biggest—perhaps only—talking point between now and Christmas, so I wanted to offer some substance behind our actions (or in this case, inactions).

Let us be clear, while these are uncharted waters, political uncertainty is nothing new. On this occasion, as in the past, people will jump over themselves to tell you the “right way”. Whether we are judging the merits of the candidates or working through our investment positioning, we must favour research over reaction and urge all our clients to do the same.

Chief among these is the temptation to react too quickly or with too much confidence in the lead up to the outcome of this significant event.

If you are cynical of this stance, I share the below quotes from the U.S. election and Brexit referendum, where even the smartest of people got it grossly wrong.

> Incorrect U.S. Election Predictions (U.S. stocks rallied 2.22% on the day after the election and around 9% in the three months following)

“We would expect a small global stock market rally if Clinton wins (about 2 percent) and a large decline if Trump wins (about 10 percent)”. Eric Zitzewitz, Professor of Economics at Dartmouth College

“The S&P 500 will fall by 3% to 5% immediately if Trump is elected”. Tobias Levkovich, Citigroup's chief U.S. equity analyst

“If investors are wrong and Trump wins, we should expect a big markdown in expected future earnings for a wide range of stocks – and a likely crash in the broader market.” Simon Johnson, professor at MIT Sloan and former chief economist of the IMF

> Incorrect Brexit Referendum Predictions (U.K. stocks fell 3.15% the day after the referendum but gained around 13% in the six months following. Economic growth also continued to rise)

“A vote to leave would tip our economy into year-long recession with at least 500,000 UK jobs lost”. George Osborne, served as Chancellor of the Exchequer under Prime Minister David Cameron

“Leaving Europe would tip the country into recession”. David Cameron, ex-Prime Minister UK

“Brexit would trigger recession”, predicted -0.3% GDP for Q3”. IMF Forecasts

“Short term impact of -1.25% GDP”. OECD Forecasts

“It would be likely to have a negative impact in the short term… I certainly think that would increase the risk of recession”. Mark Carney, Bank of England

> What about a Corbyn government?

Political biases aside, two of the widely quoted risks to investors seems to be in a Corbyn government or a hung parliament. It is easy to build an ugly bear case—no matter which scenario you look at—and we are mindful that the media will take full advantage of this fear-driven sentiment (they want to sell newspapers after all). We urge investors to keep a level head, and while these issues have substance, investors should look through media exaggeration as political risk is largely unpredictable.

It is for circumstances like this that we take a diversified approach. We don’t go “all in” on a given outcome, because we can limit the risks by spreading your eggs across multiple baskets. We have global exposure, defensive exposure and different currencies, to name a few, which would all help buffer any election risks.

Last, we leave you with a few key points.

1. The key question on many investors lips is whether they should sell, hold or buy. To our eye, the answer is simple… manage risks, stay informed and—if in doubt—stay the course.

2. Any turbulence in markets may create great opportunities to purchase assets that will add meaningfully to returns in the future. We are not there yet, but we will look at this opportunistically.

3. We appreciate that the current period is very unsettling for investors and will cause debate among your families. We will do our utmost to support our clients during this time.