MARKET INSIGHTS: THE WEATHER IS CHANGING

The weather certainly feels like it has changed recently, hence I wanted to send an update on investment markets.

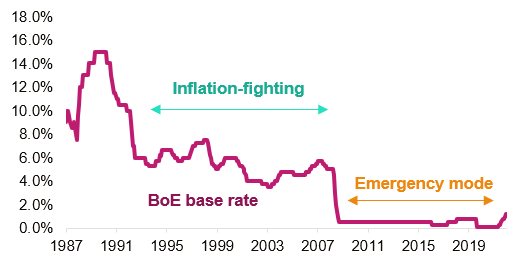

The battle against inflation has continued, Central Banks pushed through more Interest Rate hikes last month, the market barely flinched. Still firmly entrenched in Emergency Mode, interest rates will continue to rise until prices start to fall, which if course is going to have consequences for growth. A rate environment like pre-crisis is the most likely outcome, but there is going to be a fair bit of pain before we get there:

Inflation (CPI came in particularly high at 10.1%, with a 12.6% annual increase in food prices driving the reading above all estimates. This is up from 9.4% in June and marks the first time that UK prices have risen by double digits year-on-year since 1982. Given the implications this has for monetary policy, a sell-off in sterling-denominated assets followed, with the probability of a 75bp BoE interest rate hike increasing to around 30%. With further inflationary pressure expected from the energy price cap rises later this year, the outlook is left looking fragile, with the brutal squeeze on purchasing power far from over. While UK consumer confidence reading fell to a 50 year low on Friday coming in at –44, UK retail sales Ex Auto/ Fuel came in much better than expected at 0.4%.

The drought will no doubt exacerbate the problem further - farmers are finding life extremely challenging, with impending food shortage on top of ongoing energy disruption.

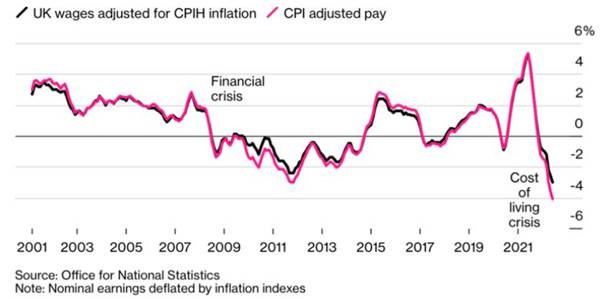

Thought this was quite a scary chart – REAL pay in the UK is falling at the fastest pace in 21 years.

Flash estimates suggested that euro zone GDP grew 3.9% year-on-year in Q2, below expectations and slightly down from the previous quarter. Inflation, on the other hand, remained persistent, with final HICP inflation at 8.9% for July as the region continues to suffer from the ramifications of Ukraine’s ongoing conflict with Russia.

In the month to July, US retail sales were unchanged, indicating that a degree of robustness remains among households. Unfortunately, the housing market is not displaying the same strength, with homebuilding squashed to the lowest level in over a year by high mortgage rates and construction material costs, muddying the country’s outlook. In line with these mixed signals, FOMC minutes were firm on inflation but acknowledged the wider economic implications of persistently aggressive policy. As a result, the committee resolved to continue hiking rates until inflation starts to decline but noted it may be appropriate for the pace of these increases to slow at some point, in order to assess their impact on the economy. This followed last week’s cooler inflation figure, which the market interpreted as a reduction in the likelihood of a 75bp September hike (measured at 40% post-release, down from around 50% before).

Equity markets are largely flat on the week while volumes remain low, having deteriorated throughout summer to the extent that movements are amplified. Earnings season is drawing to a close, with over 94% of the S&P 500 and 85% of EuroStoxx 600 now reported. Notably, although Target’s earning miss this week was not as bad as feared, following their earlier profit warning, it has renewed the focus on inventory and margin headwinds after the company was forced to slash prices to clear excess stock. As a result, it is possible that earnings estimates may need to be revised downwards in the coming months.

In China, the PBoC unexpectedly loosened monetary policy, cutting its medium-term lending rate by 10bps to 2.75% in an attempt to spur economic activity. This came after the announcement of surprisingly weak retail sales and industrial output growth as both consumer and business confidence have been depressed by COVID measures and the property market crisis. Now faced with structurally weak credit demand, evidenced by new yuan loans falling dramatically in July, policymakers are constrained by fears of stoking inflation. For now, in addition to the rate cut, Premier Li Keqiang has urged six major provinces to boost growth measures and balance COVID restrictions with economic performance whilst Chinese regulators look to guarantee bond issuance by property developers in an effort to buoy a systemically significant industry for the country.

Oil prices fell roughly 2% this week as the relatively weaker global economic outlook dampened demand while supply looks set to expand, with increased US shale production, rebounding Libyan production, and a potential nuclear agreement with Iran which would permit more oil exports.

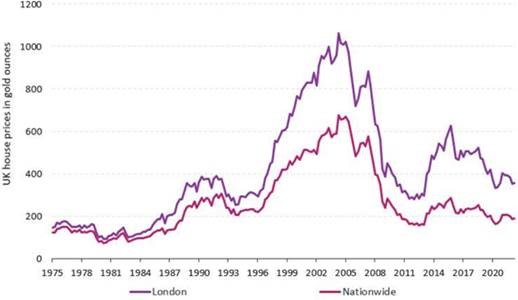

There’s been plenty in the press about slowing annual house price growth. What if you were to lot a chart showing how many ounces of gold you need to buy a house in the UK? Prices are not as lofty as you might think in those terms.

Risks : Buying Investments can involve risk. The value of your Investments and the income from them can go down as well as up and is not guaranteed at anytime. You may not get back the full amount you invested. Information on past performance is not a reliable indicator for future performance. This information is intended for educational purposes and should not be considered a recommendation to buy or sell a particular security. The views expressed here are subject to change without notice and we can’t accept any liability for any loss arising directly or indirectly from any use of it.

To discuss your financial requirements or obtain other information click below