MARKET INSIGHTS: THINK TWICE ABOUT CHASING THE BIGGEST SHARES

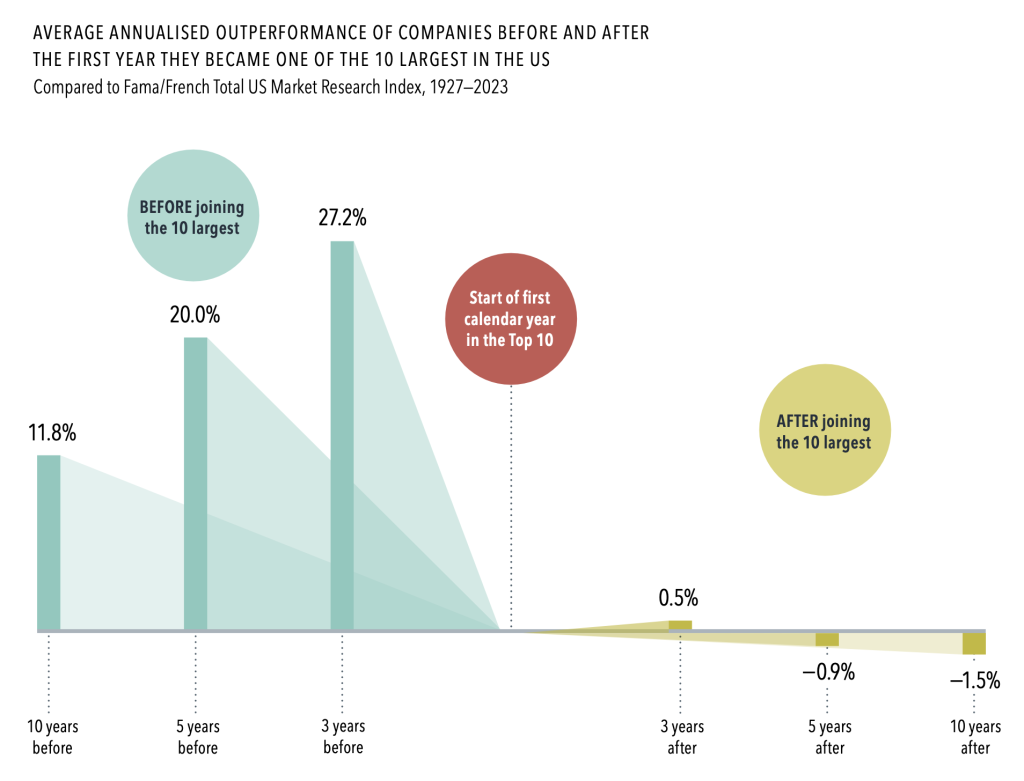

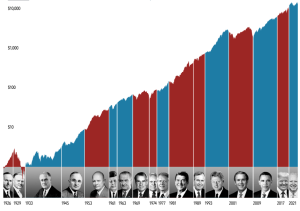

Sometimes it’s a matter of context and history. Looking at the largest equity market in world it’s interesting to note average annualised outperformance of companies before and after the first year they became one of the 10 largest in the US.

This is a cautionary tale for investors expecting continued outperformance of the biggest companies in the world. In fact, rather than seeking additional exposure to these mega cap shares, investors should ensure their portfolios are broadly diversified to capture the returns of whatever companies ascend to the top in the future.