MARKET INSIGHTS: THINK TWICE ABOUT CHASING THE BIGGEST SHARES

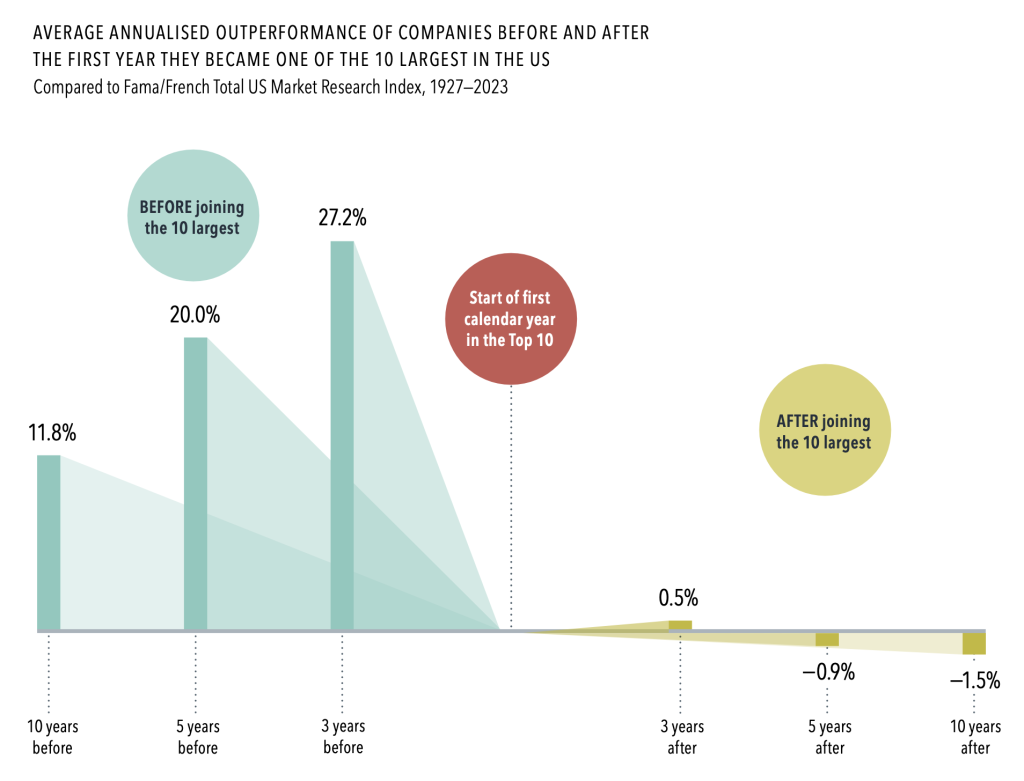

Sometimes it’s a matter of context and history. Looking at the largest equity market in world it’s interesting to note average annualised outperformance of companies before and after the first year they became one of the 10 largest in the US.

BR>

This is a cautionary tale for investors expecting continued outperformance of the biggest companies in the world. In fact, rather than seeking additional exposure to these mega cap shares, investors should ensure their portfolios are broadly diversified to capture the returns of whatever companies ascend to the top in the future.

Past performance is not a guarantee of future results.

As companies grow to become some of the largest on the US stock market, their returns can be impressive. But not long after joining the Top 10 largest by market cap, these shares, on average, have lagged behind the market.

• From 1927 to 2023, the average annualised return for these shares over the three years prior to joining the Top 10 was more than 25% higher than the market.

• Five years after joining the Top 10, these shares were, on average, under performing the market—a stark turn around from before. The gap was even wider 10 years out.

• Given the uncertainty we usually recommend a broad range of investments to reduce risks for our clients.

Expectations about a firm’s prospects are reflected in its current shares price. Positive news might push prices higher, but those changes are not predictable.

Risks : Buying Investments can involve risk. The value of your Investments and the income from them can go down as well as up and is not guaranteed at anytime. You may not get back the full amount you invested. Information on past performance is not a reliable indicator for future performance. This information is intended for educational purposes and should not be considered a recommendation to buy or sell a particular security. The views expressed here are subject to change without notice and we can’t accept any liability for any loss arising directly or indirectly from any use of it.

To discuss your financial requirements or obtain other information click below

Share this article with your friends by clicking below