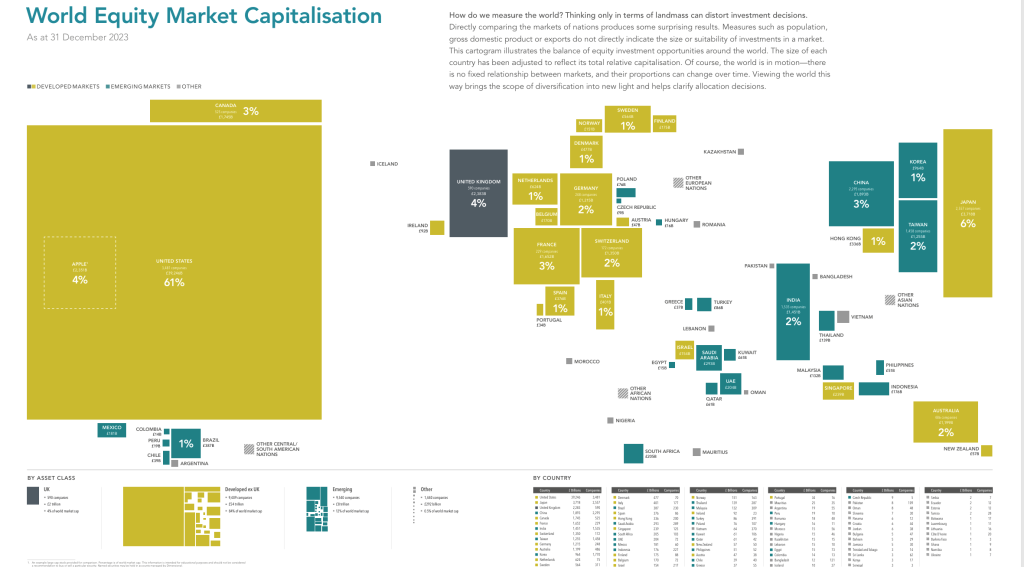

MARKET INSIGHTS: THE VALUE OF STOCKS AROUND THE WORLD

This infographic seems to be a favourite at client meetings as not many people have seen the World Equity Market Capitalisation presented in this way. This was as at the end of December 2023 where Apple represented 4% of valuations which is quite astonishing when you see that the value of the UK is only c. 4%.

It’s clear the US is the biggest market in the world and why a diversified investment approach taking these weightings into account makes sense.

Given the size of this you may need to click on the zoom in button below to view the enlarged version