Financial Protection – Ensuring a Secure Future for you and your loved ones

Posted by

Gurdev Aujla

on July 26, 2024

Leave a Comment

FINANCIAL PROTECTION:

ENSURING A SECURE FUTURE FOR

YOU AND YOUR LOVED ONES

Welcome to our July/August 2024 Newsletter. Nobody wants to consider what would happen if they became too ill to support their family financially. Financial protection is essential to creating a secure future for your loved ones, but understanding what cover you may need can be confusing. On page 8, we discuss whether you have considered the implications financially if you or someone in your family were unable to earn money, became ill or were to die prematurely. It’s not something we like to think about, but if you have left regular employment and are now either retired or have become self-employed, then any previous protection you received from an employer becomes your responsibility. On page 05, we delve into a new analysis of FCA figures. Since 2015, individuals over the age of 55 with defined contribution (DC) pension pots have enjoyed full freedom to decide how to manage their pensions; purchasing an annuity (a guaranteed income for life) is no longer mandatory. We examine how people have utilised these newfound freedoms and the tax implications that have followed. On page 10, we look at ways to potentially reduce a Capital Gains Tax (CGT) liability. Cuts to the CGT exemption mean that arranging your investments as tax-efficiently as possible is more important than ever. Trusts are a powerful tool for estate planning, providing flexibility and control over asset distribution. Properly structured, they can address various scenarios and requirements, ensuring that your legacy is managed according to your wishes long into the future. Read the full article on page 06. A complete list of the articles featured in this issue appears on pages 02

Risks : Buying Investments can involve risk. The value of your Investments and the income from them can go down as well as up and is not guaranteed at anytime. You may not get back the full amount you invested. Information on past performance is not a reliable indicator for future performance. This information is intended for educational purposes and should not be considered a recommendation to buy or sell a particular security. The views expressed here are subject to change without notice and we can’t accept any liability for any loss arising directly or indirectly from any use of it.

To discuss your financial requirements or obtain other information click below

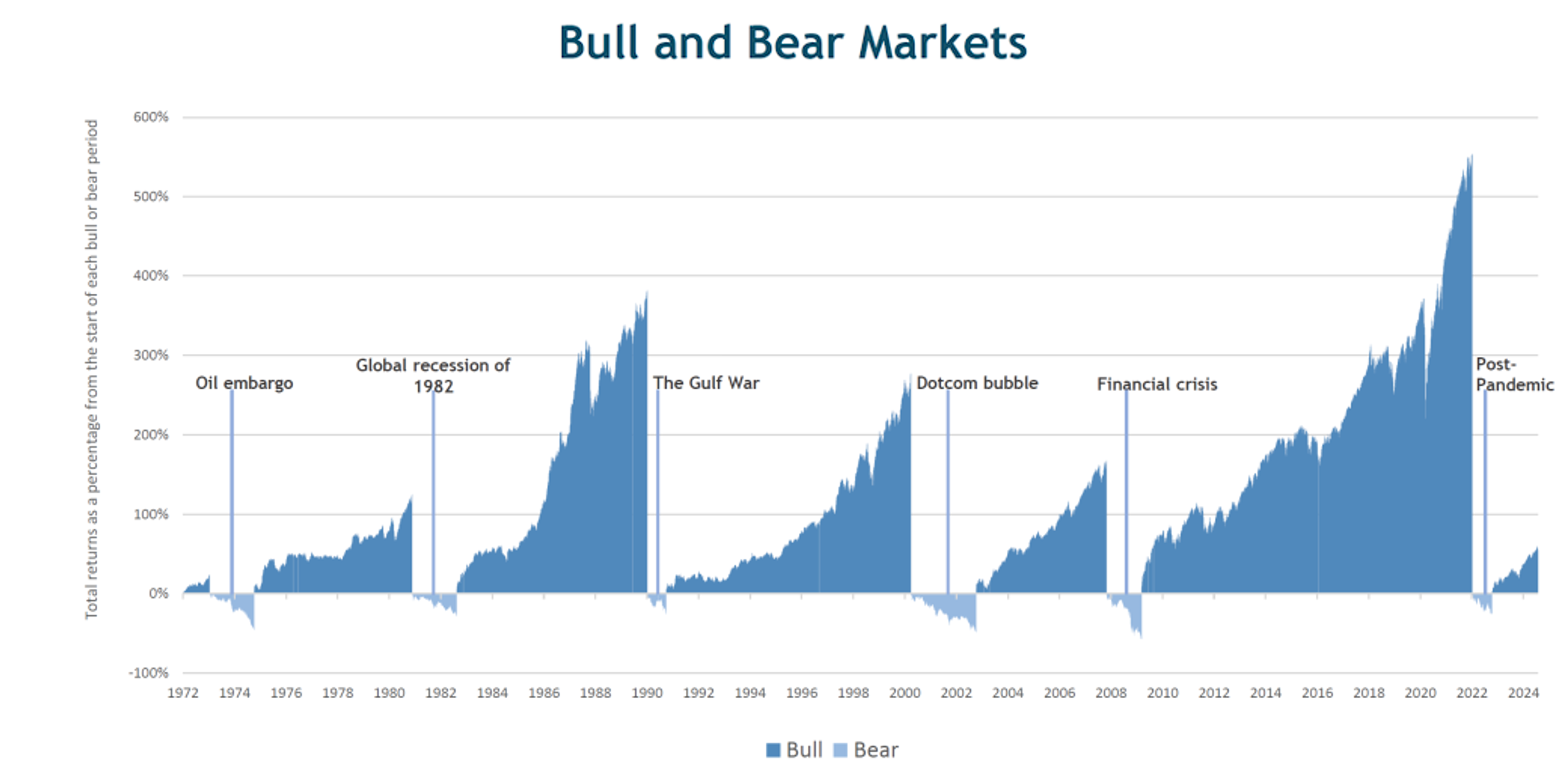

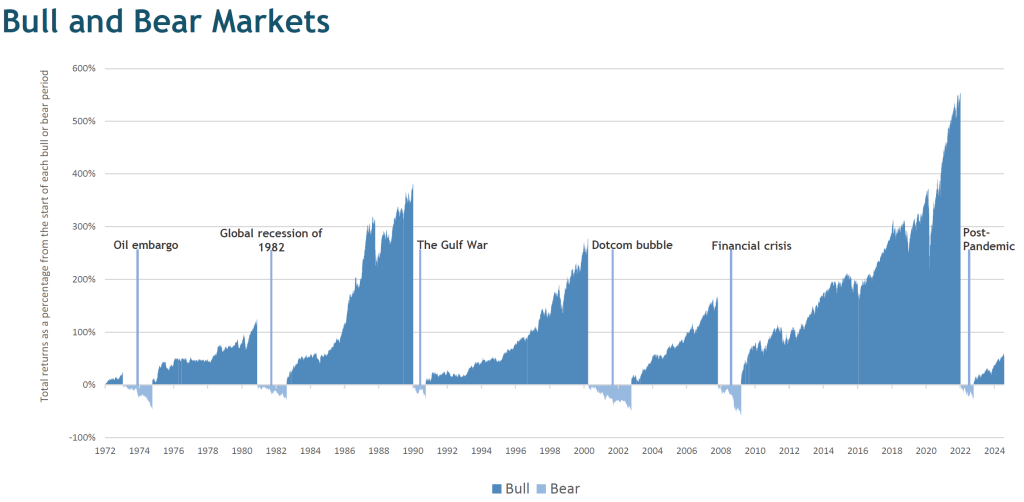

MARKET INSIGHTS: IT'S NOT AS BAD AS YOU THINK

There’s been lots of excitement in the Olympics and also recently in financial markets. So I thought it timely to highlight an interesting paper from Goetzmann, Kim and Shiller (2024) called ‘Emotions and subjective crash beliefs’. The authors find strong evidence that investors consistently overestimate the probability of a catastrophic stock market crash compared with the historical frequency of such events, and compared with option prices, which are already skewed. They also find that worries rise after unusual exogenous shocks. For example, investors significantly raise the probability of an earthquake happening after one has happened. Many people will recognise this trait in themselves, with outlook estimates often tainted and adjusted with the benefit of hindsight, reflecting recent events. Various factors help explain this anxiety. For starters, negative news is more prominent and memorable than positive news. Investors also display loss aversion, so overestimating crash risk is a way to safeguard individuals against potentially irrecoverable personal financial loss. The authors also note that institutional investors are marginally better calibrated than individuals when estimating crash risk. An example is in geopolitics. It’s difficult to get an edge in geopolitics when tensions are slowly but gradually increasing, so positioning for an escalation or normalisation is difficult as markets normally slightly overestimate the risks but are no better or worse at pricing that risk than we are. It’s worth noting that most of these tensions pass with little lasting impact on fundamentals. See the chart below for context which shows you’d be much better off staying invested to achieve your outcomes over time.

Source: FE Analytics. MSCI World Index from 3rd January 1972 to 30th June 2024. Index returns do not reflect management

fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. Please note that this chart is split up into separate bull and bear periods, each of which begins again from zero. So they can be considered as a series of charts run adjacent to each other. A bull/bear market is defined as a 20% rise/drop from its previous peak with a minimum of 6 months duration. Past performance does not predict future returns.

Risks : Buying Investments can involve risk. The value of your Investments and the income from them can go down as well as up and is not guaranteed at anytime. You may not get back the full amount you invested. Information on past performance is not a reliable indicator for future performance. This information is intended for educational purposes and should not be considered a recommendation to buy or sell a particular security. The views expressed here are subject to change without notice and we can’t accept any liability for any loss arising directly or indirectly from any use of it.

To discuss your financial requirements or obtain other information click below

Share this article with your friends by clicking below

How much impact does the US President have on US Stocks?

Posted by

Gurdev Aujla

on September 1, 2024

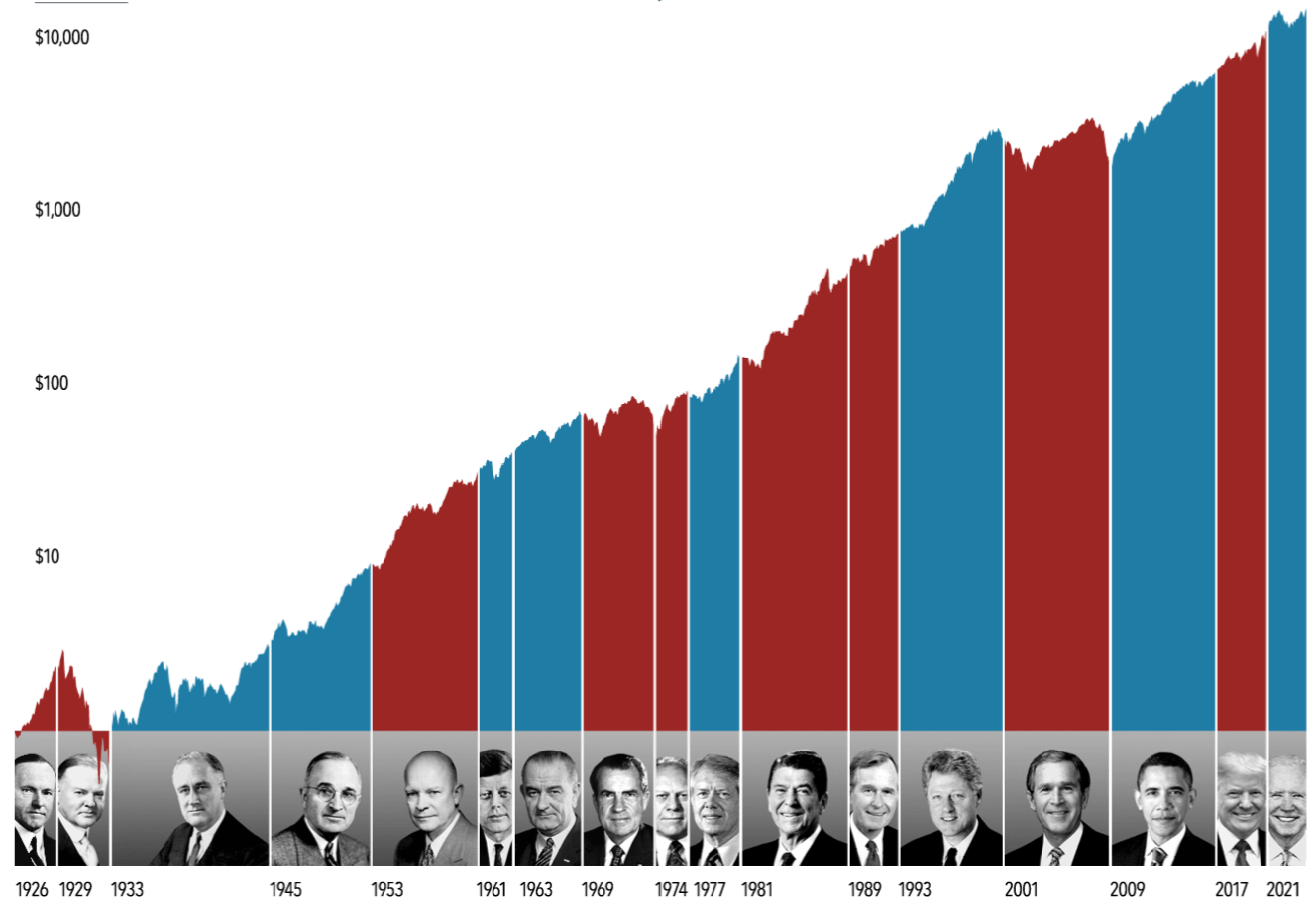

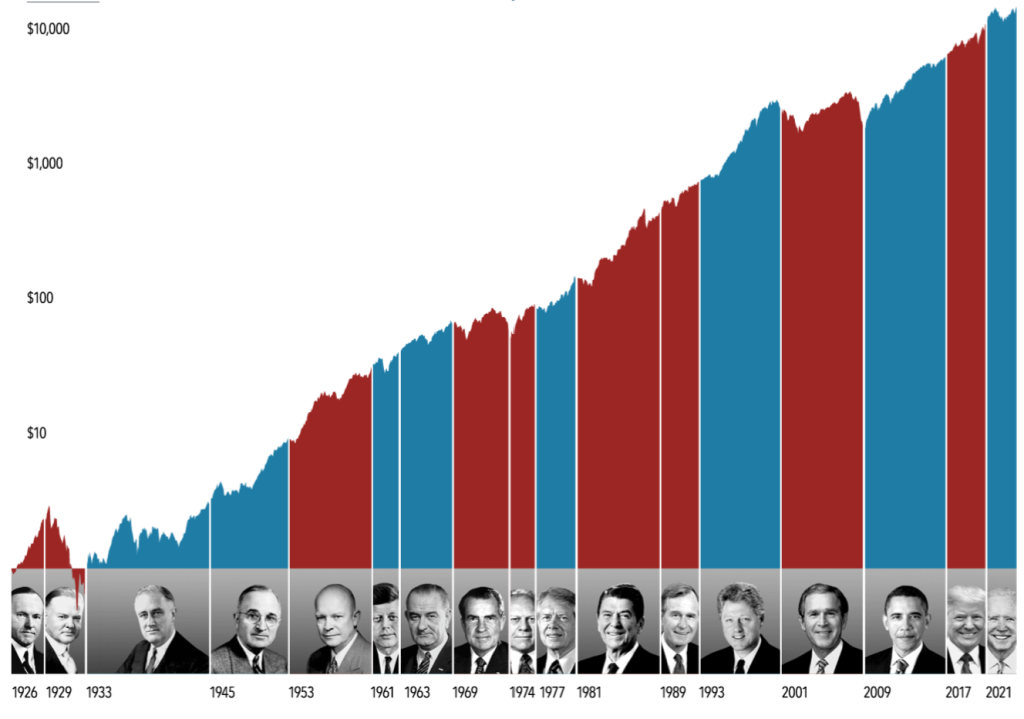

MARKET INSIGHTS: HOW MUCH INFLUENCE DOES THE US PRESIDENT HAVE ON US STOCKS?

In anticipation of tonight’s Presidential Debate there might be questions about how financial markets respond during elections. But the outcome of an election is only one of many inputs to the market. This exhibit examines market data for nearly 100 years of US presidential terms and shows a consistent upward march for US equities regardless of who’s in the Oval Office. This is an important lesson on the benefits of a long-term investment approach.

Growth of $1 1926-2023

This material is in relation to the US market and contains analysis specific to the US.

In US dollars. Stock returns are represented by the S&P 500 Index. Source: S&P data © 2024 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved.

Data presented in the growth of $1 chart is hypothetical and assume reinvestment of income and no transaction costs or taxes.

The chart is for illustrative purposes only and is not indicative of any investment. Growth of wealth for the full sample from January 1, 1926, through December 31, 2023. Growth of wealth for each presidential term starts on the inauguration month of each president up to but not including the inauguration month of a successor. Growth of wealth for Calvin Coolidge's term starts on January 1, 1926, based on the inception date of the S&P 500 Index.

Risks : Buying Investments can involve risk. The value of your Investments and the income from them can go down as well as up and is not guaranteed at anytime. You may not get back the full amount you invested. Information on past performance is not a reliable indicator for future performance. This information is intended for educational purposes and should not be considered a recommendation to buy or sell a particular security. The views expressed here are subject to change without notice and we can’t accept any liability for any loss arising directly or indirectly from any use of it.

To discuss your financial requirements or obtain other information click below

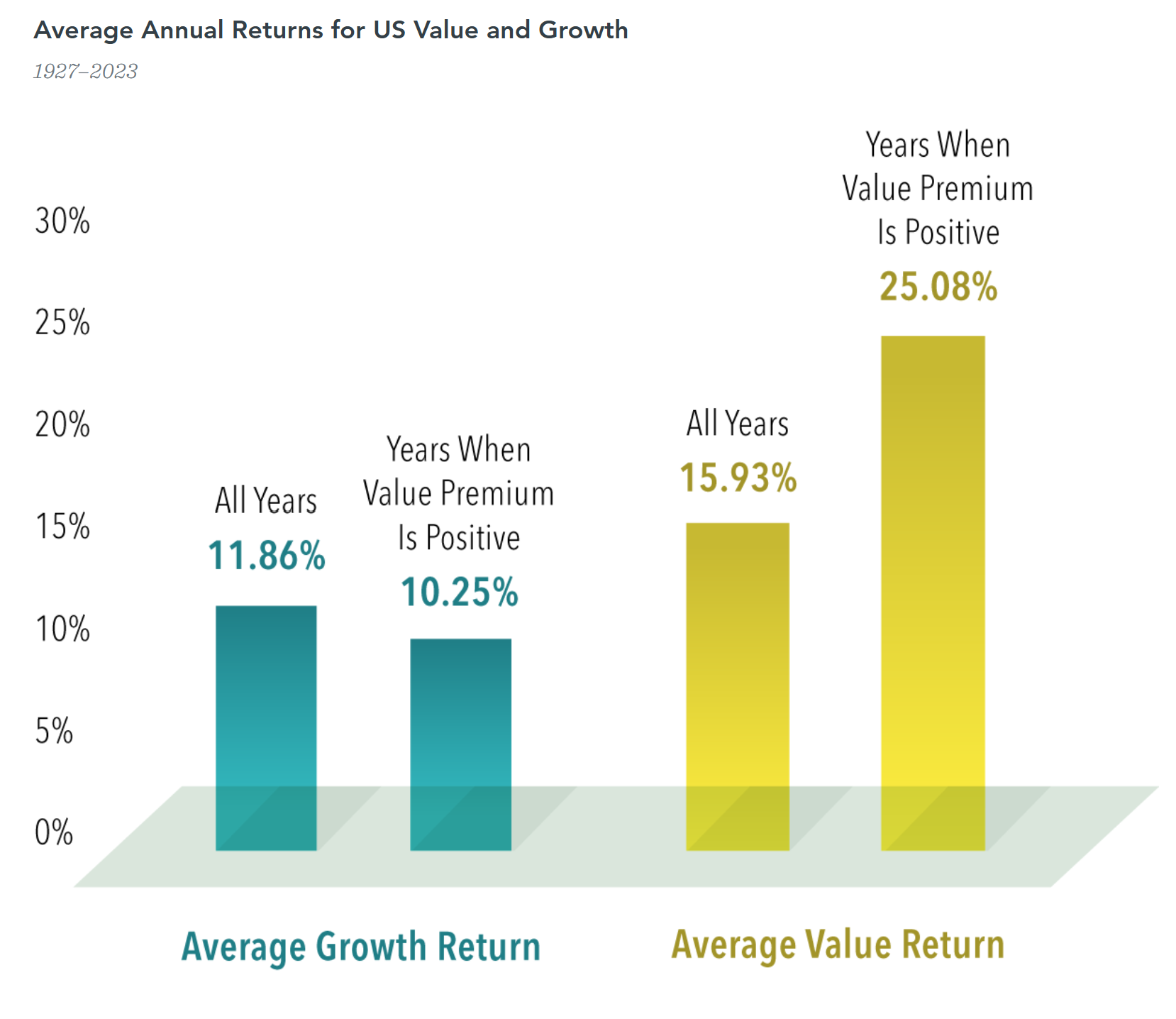

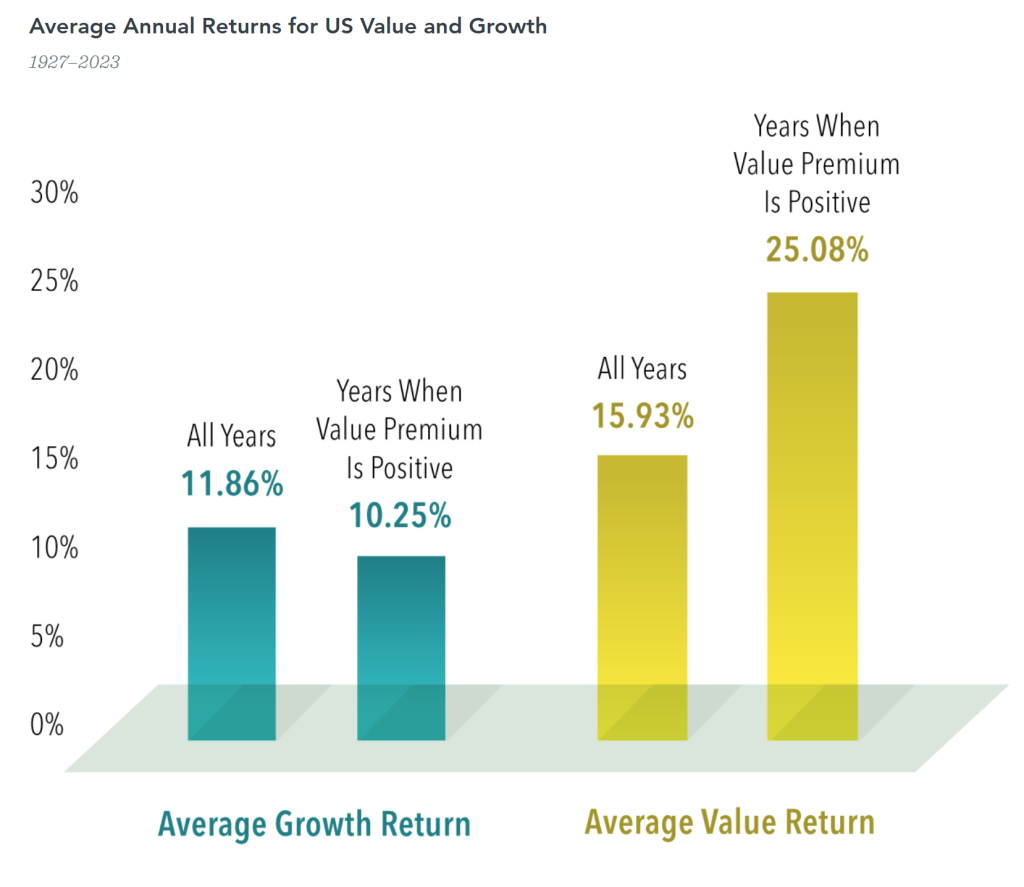

MARKET INSIGHTS:VALUE CAN POP WITHOUT A GROWTH DROP

Growth stock stories can be compelling for investors - and make for great news. However it’s worth noting historically that value stocks have outperformed growth stocks in the US (which is the largest stock market in the world by far), often by a striking amount. Data covering nearly a century backs up the notion that value stocks—those with lower relative prices—have higher expected returns. It’s possible to think value stocks post strong relative returns only because growth stocks underperformed, not because value delivered strong absolute performance. Since 1927, US value stocks outperformed US growth stocks in 58 out of 97 calendar years. During positive value premium years, growth stocks returned an average of 10.25% compared to their average across all years of 11.86%—lower, but not exactly a tank job. Only in 17 out of 58 positive value premium years was growth’s return negative. On the other hand, value’s average return in positive value premium years, 25.08%, markedly exceeded its long-run average return, 15.93%. We will take this into account when it comes to saving for your future.

Index Descriptions Fama/French US Value Research Index: Provided by Fama/French from CRSP securities data. Includes the lower 30% in price-to-book of NYSE securities (plus NYSE American-listed equivalents since July 1962 and Nasdaq equivalents since 1973). Fama/French US Growth Research Index: Provided by Fama/French from CRSP securities data. Includes the higher 30% in price-to-book of NYSE securities (plus NYSE American-listed equivalents since July 1962 and Nasdaq equivalents since 1973).

Results shown during periods prior to each index’s inception date do not represent actual returns of the respective index. Other periods selected may have different results, including losses. Backtested index performance is hypothetical and is provided for informational purposes only to indicate historical performance had the index been calculated over the relevant time periods. Backtested performance results assume the reinvestment of dividends and capital gains. Profitability is measured as operating income before depreciation and amortization minus interest expense scaled by book. Eugene Fama and Ken French are members of the Board of Directors of the general partner of, and provide consulting services to, Dimensional Fund Advisors LP

Risks : Buying Investments can involve risk. The value of your Investments and the income from them can go down as well as up and is not guaranteed at anytime. You may not get back the full amount you invested. Information on past performance is not a reliable indicator for future performance. This information is intended for educational purposes and should not be considered a recommendation to buy or sell a particular security. The views expressed here are subject to change without notice and we can’t accept any liability for any loss arising directly or indirectly from any use of it.

To discuss your financial requirements or obtain other information click below

Autumn Budget Statement 2024

Posted by

Gurdev Aujla

on September 16, 2024

Autumn Budget Statement 2024

Welcome to our latest issue.. On 30 October, Chancellor of the Exchequer Rachel Reeves will deliver the Autumn Budget Statement 2024. It will be a critical indicator of the government's approach to managing the economy, aiming to foster an environment conducive to sustainable growth. The outcomes of this Autumn Budget will have far-reaching implications, potentially influencing everything from tax rates and public services to business investment and consumer confidence. As such, it is a pivotal moment that will shape the economic landscape in the months and years ahead. On page 10, we look at what it could mean for your finances. Since this has been written Capital Gains Tax has been branded 'ripe for reform' ahead of the Budget. On Page 8 we discuss Intergenerational Planning and Inheritance Tax which may be relevant for you or your parents/family. More than three-quarters (78%) of retirees have already dipped into their pension pots by the time they retire, according to recent data. This trend highlights a significant shift in retirement planning behaviours, where immediate financial needs or desires often outweigh the long-term benefits of leaving pension funds untouched. The implications of early withdrawals are multi-faceted and can significantly impact retirees' financial security. Turn to page 05.