Make the Most of Your ISA Allowance

Typical reasons you might invest in an ISA:

- Accessibility: You can access your funds at any time, making it a practical way to build up capital. Bear in mind that the larger the gains over time, the more valuable the tax free benefit.

- Mortgage Repayment: An ISA can be a smart way to accumulate a tax-free fund that can be used towards repaying a mortgage.

- Long-term Savings: Many clients use ISAs to build a tax-free fund for their retirement provision.

- Private Education: Couples often use ISAs as a means of saving for their children’s private education.

Benefits of a stocks and shares ISA:

- Tax-free Growth: Your investments purchase units in funds covering various geographical regions, sectors, and assets. Ideally, you will benefit from both capital and dividend growth. All income and capital gains from investments within the ISA are currently free from tax.

- Flexibility: An ISA can be a smart way to accumulate a tax-free fund that can be used towards repaying a mortgage.

- Professional Management: Many clients use ISAs to build a tax-free fund for their retirement provision.

Benefits of a stocks and shares ISA:

- No Income Tax: There is no tax payable on income generated from your ISA.

- No Capital Gains Tax: Any capital gains arising from your investments are not subject to tax.

- No Reporting to HMRC: You are not required to inform HMRC about any income or capital gains earned from your ISAs.

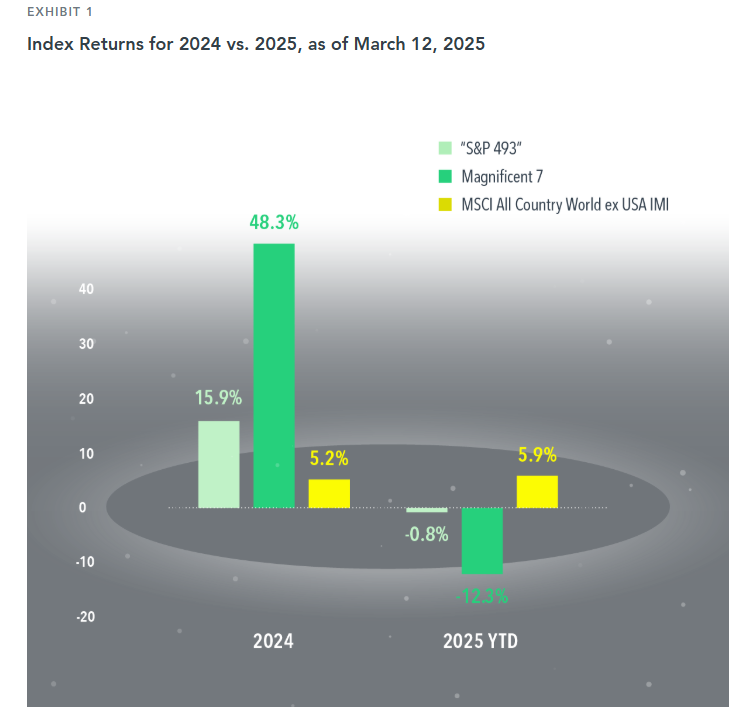

If top stocks exert a gravitational pull on the broad market’s return, the Magnificent 7 (Apple, Nvidia, Amazon, Tesla, Meta, Microsoft, Alphabet) have acted like the TON 618 black hole over the US the past few years.1 Accounting for about one-third of the S&P 500 Index’s weight2, the performance of these stocks has been a big driver of market-capitalization-weighted US large cap stock index returns.

This force can pull in a positive or negative direction. In 2024, the S&P 500 returned 25.0%. This was driven heavily by the Magnificent 7, which returned 48.3%. The other 493 stocks in the index collectively returned 15.9%. This year, the opposite effect has played out: The Magnificent 7 returned –12.3% through March 12, compared to –0.8% for the “S&P 493.”

The swings in performance for a US large cap index make a compelling case for global all cap diversification, which helps lessen exposure to the Magnificent 7. While non-US stocks underperformed the US in 2024, the MSCI All Country World ex USA IMI Index is outpacing the US thus far in 2025. Diversifying across regions and market capitalization is one way to mitigate the impact of a handful of stocks.

1. Francis Reddy, “NASA Animation Sizes Up the Universe’s Biggest Black Holes,” National Aeronautics and Space Administration, May 1, 2023.

2. As of December 31, 2024.

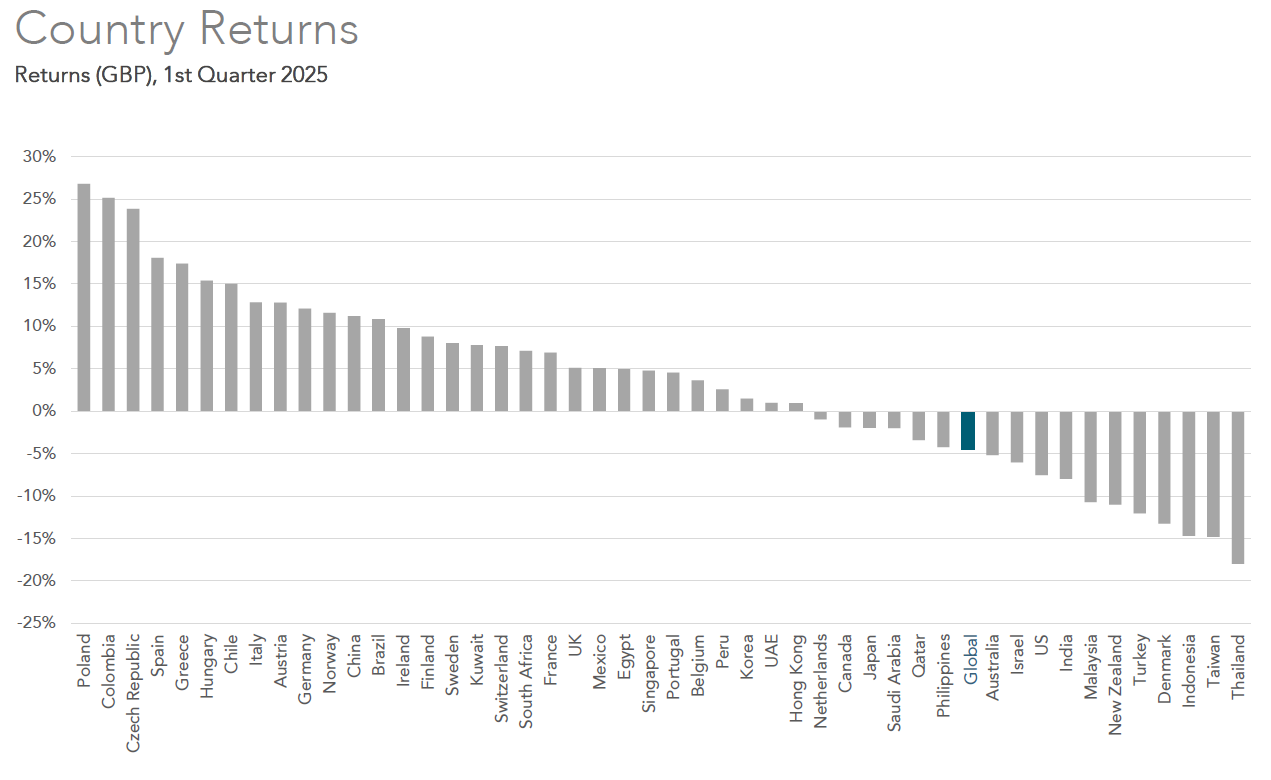

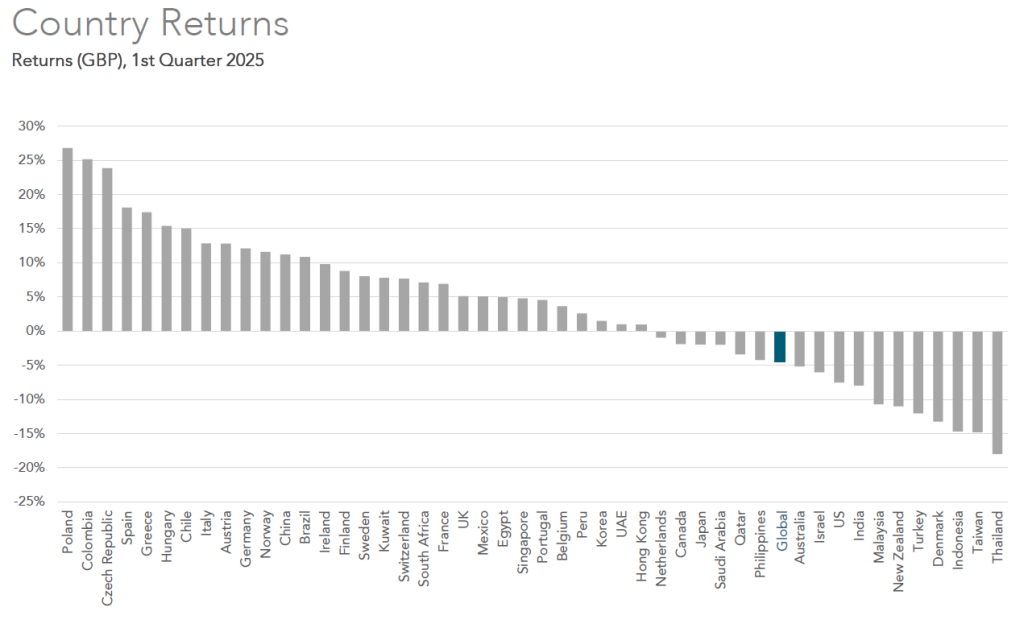

Here's a breakdown of what happened last quarter. This is for those of you interested in aspects such as which countries returns were higher or whether Value / Growth or Smaller companies performed better in the period. I am aware that there have been many movements since April however for the purpose of completeness this covers the first quarter of the year. This is also evidence that maintaining well-diversified, long-term thinking in your investment approach rather than reacting to daily valuations is key. We can help you develop and monitor carefully considered plans to meet your life objectives for the future which is probably more important to you!

Welcome to our latest issue. The October 2024 Budget proposed sweeping changes to Inheritance Tax (IHT), significantly tightening the laws that were previously more forgiving for families with trading businesses and farmland. Effective from April 2026, these types of assets will now incur IHT at a reduced rate of 20% on valuations exceeding £1 million. On page 04, we consider why the changes are leaving many families scrambling to reassess their estate planning strategies. Ten years ago, pension freedoms revolutionised how people access their retirement savings. These changes offered savers over 55 greater options to withdraw and manage their pension pots. However, a decade later, research indicates that many individuals are making critical financial decisions without seeking advice or fully understanding the tax implications. Read the full article on page 03. A complete list of the articles featured in this issue appears on page 02.

Considering how dire the headlines and stock price moves appeared to be in April with the Tariff headlines I know it’s tempting to move to the sidelines and delay making investments or even sell and wait and see how things develop with a view to ‘re-entering the market’ when valuations might be more attractive and the outlook clear. The problem is the evidence suggests that approach rarely works out! With new record highs being made in the US stock market last week I thought it’s worth reflecting on this.

The impact of being out of the market for a short time can be profound, as shown by this hypothetical investment in the MSCI World Index, a broad Global stock market benchmark.

Investment Example

-

A hypothetical £1,000 investment made in 2015 turns into £3,214 for the 10-year period ending December 31, 2024.

-

Miss the MSCI World’s best week, and the value shrinks to £2,940. Miss the best three months, and the total return falls to £2,498.

-

There’s no proven way to time the market—targeting the best days or moving to the sidelines to avoid the worst. Staying invested and focused on the long term helps to ensure that you’re in position to capture what the market has to offer.